Handout: Market Failure

7th September 2015

Types of Market Failure

Market failure refers to the situations where free market forces have resulted in an inefficient allocation of resources.

Market failure may occur for a number of reasons. There may be market externalities. Economic growth may lead to the production and consumption of goods increasing. The production and consumption of goods will create costs and benefits. Some of these costs and benefits may be private and be borne by the individual consumer or the firm involved and this will be reflected in the market price. Other costs may be social and these will affect individuals who are neither buyers nor sellers. Market failure can occur when externalities attributable to production or consumption are high.

Externalities

Externalities refer to all costs and benefits that affect third parties – an alternative name for them is spill-over effects. If the social costs exceeds the private costs, there is a negative externality.

Social costs are the full costs of production – both private and external costs. Private costs are those costs which a firm incurs as a result of its commercial activities. External costs are ones which society must bear as a result of the firm’s activities.

Public goods

Public goods are services which will not be supplied by market forces. This is because a commercial organisation will find it difficult to charge for these services. Once provided, public goods are available to everyone. No-one can be excluded from the benefits of public goods. When a person uses them, they will not be used up but will remain available others. The only effective way to provide public goods is to charge people collectively for them through taxation.

Examples of Public goods include:

- Defence (few people can afford their own private army)

- The judiciary

- Streetlights (can you have your own personal system of street lighting, which own lights up for you?)

- Lighthouses (lighthouses help boats to steer away from shipping hazards, but could many ship owners afford their own lighthouse? Even if they could, how would they stop other ship owners using the light to steer their ships away from hazards).

- The lighthouse example highlights an underlying problem surrounding the provision of public goods. This problem is often referred to as the ‘free-rider problem,’ which is if you provide a good or service for one person you provide it for all.

Where the market does not provide a good or service there is said to be a missing market.

The Government can step in and provide goods and services which will not be provided by the market. Funding for the provision of public goods can be secured by taxation, overcoming the free-rider problem. The problem with taxation to fund public goods is that those who do not use the good or service will still have to pay taxes.

Merit Goods

There two elements to a merit good. Firstly, people do not appreciate the true benefit of their consumption e.g. Can education save your life? Ask that question to someone facing a minefield with a sign in front saying, ‘Keep Out Danger!’

Secondly, merit goods tend to have positive externalities.

Merit goods may also be provided by the government where it believes that they will be under-consumed if left to the markets to provide. The government will provide these goods because it believes that if they do not intervene in the market these goods will be under-consumed and this will be detrimental for society.

One example of a merit good is healthcare. It is possible to charge for healthcare and exclude those who do not, or are unwilling to pay for healthcare. The state may choose to supply these goods because if they do not, then they may be under consumed to the detriment of society. In the UK, healthcare is provided by the NHS, although individuals can opt to pay for private healthcare. When the NHS was created in 1945, it was intended that it would be free at the point of provision. That principal has been eroded over time with charges for prescriptions, dental care and eye tests. In the US, public healthcare is extremely limited and the majority of Americans are obliged to pay. Efforts to extend healthcare led to ‘Obamacare’ which has proved extremely contentious. Stories used to circulate about the problems of the American Healthcare system. One story told frequently was of ambulance crews who would attend road accidents. What did the ambulance crews do first? Check for breathing? Triage? No, they checked for a medical insurance card, or a credit card to ensure that the injured person could pay! Private hospitals didn’t want to be lumbered with expensive medical care costs when an aspirin will cost a patient £40. This may seem cruel and inhumane, but healthcare is a real marketplace where buyers and sellers interact. Satisfaction of a need is dependent on effective demand (an ability and willingness to buy a good at a given price). If injured motorists do not have the ability to pay, then they do not have effective demand and are denied those goods and services.

Disequilibrium

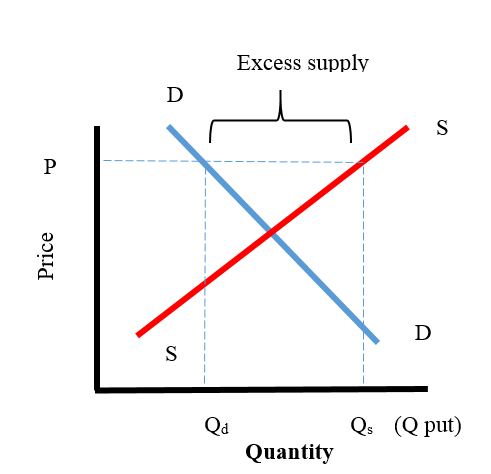

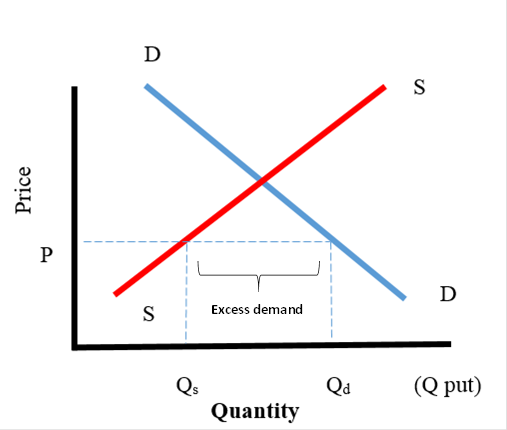

Markets can be slow to adjust to disequilibrium where the quantity demanded is markedly different to the quantity supplied (resulting either in surpluses or shortages). This can be illustrated by the diagrams below:

Excess supply arises when the quantity of a good or service supplied is greater than the quantity demanded. This will occur when the price is above the equilibrium level set by supply and demand.

Market Disequilibrium: Excess Demand

Excess demand arises when the quantity of a good or service demanded is greater than the quantity supplied. This will occur when the price is above the equilibrium level set by supply and demand.

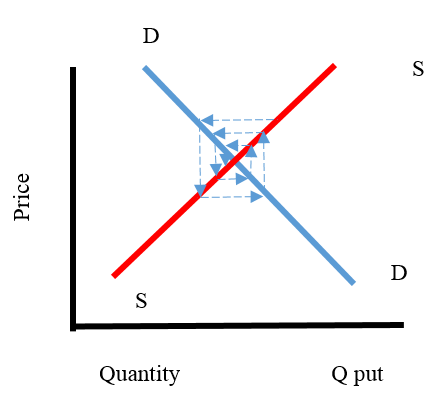

Markets may be slow to respond to disequilibrium. The labour market is an example of where this may occur. Some economists contend that if wage rates fall, employers will eventually respond and recruit everyone seeking work. In reality, this often does not happen.

Imperfect information

Imperfect information or uncertainty can effect decisions to buy or sell. One party to a transaction may have more information than another party. An example may be insider trading where confidential information is leaked and speculators use this information for the short-term advantage.

I once worked for a finance company. We provided car finance for a local garage. The garage sold a sports car to a customer and we provided the finance. The car looked nice and the customer thought they had a good deal. Several months later, we had a phone call from the irate customer, Their lovely white sports car had grass growing out of the front wing. It turned out that the car had been in an accident and had been repaired by the garage. The bodyshop had run short of bodyfiller and rather than get more a mechanic had grabbed a handful of mud, packed it into the dent and covered it with filler. When the car was left out in the rain, the mud got wet and the grass seeds in it germinated. The customer sued the finance company I worked for and got their money back. Would the customer have bought the car if they had had perfect knowledge? No! Would we have financed the car if we had known that it had a botched repair? No! Would the garage have been able to get the same amount of money for the car if potential customers knew it had been in a bad crash? No! This is a good example of imperfect information.

Cobweb Diagram (Ezekiels Hog Cycle)

Cobweb models explain irregular fluctuations in prices and quantities that may appear in some markets. The key issue in these models is time.

Imperfect Competition

Imperfect competition exists where two or more firms in a market fail to match the criteria associated with perfect competition. As a result, firms may charge more for their goods and services. Some firms may seek to dominate the market, exploiting customers and this may lead to productive inefficiency.

0 Comments