The BRIC Economies

7th October 2015

BRICS was an acronym created by Jim O’Neill from investment bank Goldman Sachs in 2001. It was used to identify a group of rapidly developing economies. The countries identified by O’Neill in his paper were Brazil, India, China and South Africa. http://www.bbc.co.uk/news/business-29960335

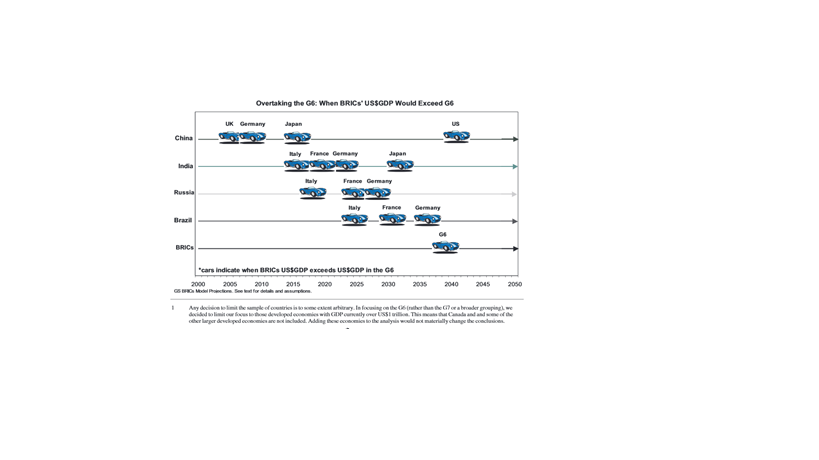

Goldman Sachs predicted that by 2050 Brazil, Russia, India and China could  become a significant force in the world economy. Goldman Sachs predicted the BRICs economies together could be bigger than the G6 in dollar terms. By 2050, the largest economies would be Brazil, India and China, Russia, Japan and the US.

become a significant force in the world economy. Goldman Sachs predicted the BRICs economies together could be bigger than the G6 in dollar terms. By 2050, the largest economies would be Brazil, India and China, Russia, Japan and the US.

Goldman Sachs predicted that BRICS could become an engine for growth and that spending power may shift towards the BRIC economies. IT was felt that higher growth in the BRIC economies could offset the impact of ageing populations and slower growth in advanced economies.

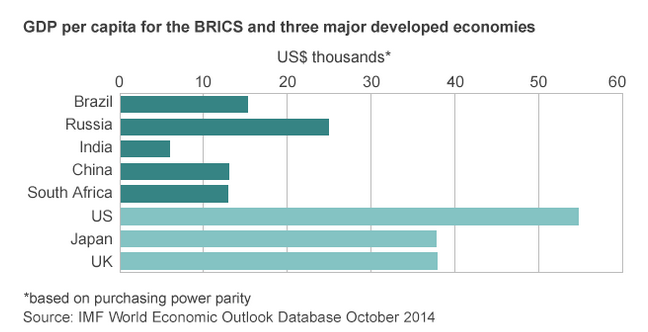

While economic projections show much faster growth in the BRIC economies the population is still likely to be poorer than populations of the G6 countries. China’s income per capita is predicted to reach levels which are comparable to those experienced by developed countries currently (c. US 30,000 per capita), however by 2050 income per capita in the US is projected to reach $80,000.

Condition to promote growth

Goldman Sachs identify the factors which need to be in place if economic growth in the BRIC economies is to meet projected growth rates. Education is vital in promoting growth. They also identify increased life expectancy, lower fertility, reduced government consumption lower inflation, improvements in the terms of trade and maintenance of law and order.

Goldman Sachs explain the significance of these key factors. Macro economic stability is important to international trade. Instability in the macro environment can distort incentives and prices. Stable prices are important in giving business confidence and is a prerequisite when liberalising and increasing trade. Inflation can discourages saving and investment.

Goldman Sachs believe that a policy of price stability should be pursued through fiscal deficit reduction, tight monetary policy and adjusting exchange rates. These policies present a challenge for some of the BRIC economies, particularly Brazil which had an inflation rate of 548% during the 1990s and a deficit of 21.2% of GDP.

Goldman Sachs also argue that stable government, functioning markets, education, healthcare and financial institutions are important in providing a climate for investment and growth.

A liberal approach to trade is also a significant factor in promoting economic growth. Studies of the relationship between trade and growth highlight different approaches. Not all countries have adopted this approach to trade, preferring to regulate trade. One approach has been the adoption of import-substitution policies, where countries erect barriers to entry and encourage infant industries to develop behind a tariff wall. This approach has been adopted by countries such as Japan. This policy allowed Japan to develop its electronics and automotive industry. Brazil also pursued this policy in order to develop its computer industry.

Other countries have adopted an export promotion approach where exchange rates are often adjusted in order to make exports more attractive. Japan after the Second World War encouraged its motorbike and car manufacturers to export goods abroad. China has also used an undervalued currency in order to promote export sales.

Goldman Sachs note that as economies grow rapidly they may encounter skills shortages and that populations need to upskill. This trend has been seen in the BRIC economies with participation rates in higher education have increased sharply. Of all of the BRIC economies India has perhaps performed worse against this criteria. Statistical evidence suggests that there is a strong correlation between education and growth rates.

BRICS are slowing down

Emerging markets now account for half of world GDP. Brazil, Russia, India and China achieved remarkable growth. One consequence of this growth was that commodity prices soared, while the cost of manufactured goods fell. While workers in developing countries saw some benefit, workers in advanced economies saw wages stagnate and income inequality grow.

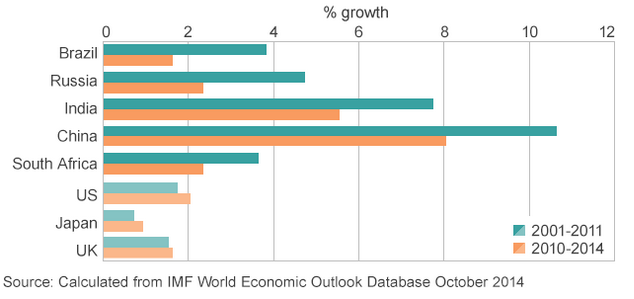

The remarkable growth of the BRICS economies seem to have stalled.

As BRIC economies slowdown, their contribution to global growth has declined.  In 2008, two thirds of world GDP growth came from the BRIC economies. By 2012, the BRIC economies accounted for less than half world growth.

In 2008, two thirds of world GDP growth came from the BRIC economies. By 2012, the BRIC economies accounted for less than half world growth.

China has allowed the yuan to appreciate by 35% against the dollar since 2005. China whilst it is the largest of the BRIC economies, China is slowing down. Volatility in the stock market and government capital controls have acted as a deterrent to investment. The Institute of Institutional Investors predict that global investors will withdraw capital out of emerging economies in an anticipation of a Chinese crash. The Chinese economy is changing from an export- led growth model to one which is driven by consumption and services. There is less emphasis on debt-financed public investment which threatened to undermine the economy.

Russia meanwhile has been hit by a global decline in oil prices and sanctions against its policy to Ukraine. It is anticipated that Russia will experience negative growth this year. South Africa is also experiencing problems. The country is struggling with stagflation and negative economic growth.

Of all the BRIC economies, India is performing better than the other countries. Growth in 2015 is approaching 8 per cent. It has a younger working population and does not have the problems which currently face Russia and China.

0 Comments