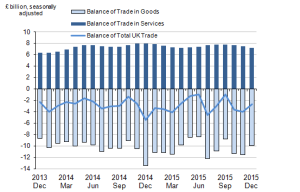

The UK’s goods trade gap with the rest of the world has increased. The trade gap reached £125bn in 2015 according to The Office for National Statistics.

Despite the widening trade gap the services sector reported a record surplus in the UK’s services sector. The trade gap in 2015 was £90bn an increase of £300m in a year. The ONS reported that the overall deficit, which is the difference between the amount the UK imports and what it exports was £34.7bn in 2015.

What the latest figures show is that Britain is very good at exporting services such as financial, tourism, creative and legal services. This is reflected in the healthy trade surplus of £90.3bn. The figures also show that UK has been singularly unsuccessful at increasing the exports of goods. Despite government initiatives to rebalance the economy away from consumer consumption towards manufacturing, firms have struggled to increase the value of goods sold overseas. This difficulty has been heightened by the value of the pound.

Analysts are concerned about slowdown in sales to Germany and China in the final quarter of 2015. The statistics reveal that the UK has seen its trade deficit with other members of the European Union widening. The good news is that Britain’s trade with the rest of the world has increased. The value of exports to countries outside the EU increased by £3.5bn.

A slight improvement in the goods deficit was seen between November and December but this was due largely to a fall in the value of imports (£1.7bn) rather than an increase in exports. The reduction in the value of imports was due to depressed oil prices. The cost of oil imports fell in value terms to their lowest level since February 2009.

Analysts believe the trade deficit is one of the factors which may lead to a slowdown in UK economic growth.

Strong Pound

The UK has benefited from a strengthening pound over the past few years. A strong pound is good for importers and great for tourists but it has a downside. A strong pound makes UK exports more expensive.

Chancellor George Osborne has expressed caution about the future prospects for the UK economy. He sees the combination of slowing global economic growth, volatile stock markets and the continuing slump in oil prices as a “dangerous cocktail.”

Samuel Tombs, chief UK economist at Pantheon Macroeconomics has analysed the latest trade figures and has identified a reduction in net trade of 0.2 percentage points in the fourth quarter of 2015. The fall in the trade deficit was due to a drop in the import of goods rather than an improvement in exports during December. The value of imports fell by 3.6pc while exports dropped by 0.8pc. It is likely that the reduction in the value of imports may be due to an appreciation in the value of the pound, however the value of the pound dropped by 5% during December which made imports relatively cheaper. Samuel Tombs expects the disappointing trade figures to continue as global trade flows slow and UK goods remain uncompetitive despite a depreciation in sterling’s value since December. He believes that the poor trade performance may damage the UK’s economic recovery this year.

The fall in the value of the pound is likely to take to have a positive impact on exports. Overseas customers and businesses remain cautious about a global downturn.

Economic growth will be increasingly reliant upon the UK’s services sector. Economists said that the depreciation would not help lift exports for some time, especially while businesses and consumers are nervous about the possibility of a global downturn.

Alison Renison, who is head of trade policy at the Institute of Directors believes that the sharp fall in the price of oil has been broadly positive since Britain is a net importer of oil. This is little comfort for North Sea Oil producers who have been badly hit by the falling oil price. The high cost of oil production in the North Sea means that there is little profit to be made from off-shore oil.