The UK’s monthly trade figures are often seen as a good guide to how the economy is performing. However, the balance of payments is much more than just a record of physical trade. The UK consistently imports more physical goods than it exports. Britain has a strong desire for German cars, cheap Chinese steel and imported fashion. This flow of imports is counter balanced by the export of financial and other services (invisible exports). The UK generates a huge surplus on its invisible trade (£70 billion currently). Invisible earnings largely cancel out the shortfall in physical trade. In spite of the fall-out of the financial crisis, income from financial and insurance services has risen sharply.

The Balance of Payments contains a third, much less understood element, Net Property Income from Abroad (NPIA). The UK earns profits from investments abroad. Every year this profit and other income is repatriated to the UK. Cash also moves abroad as UK investors buy assets abroad and profits made by foreign investors, flow out.

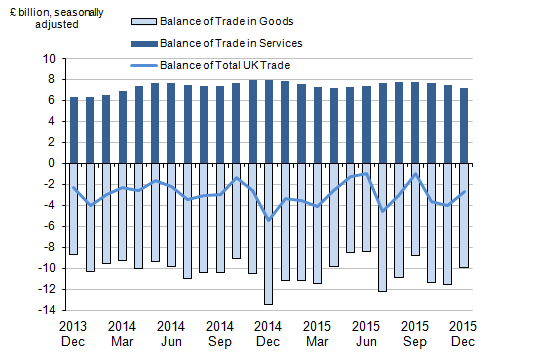

It is a matter of growing concern that the Bank of England’s latest Inflation Report reveals that there is a widening gap between the value of imports and exports in the UK current account. In the third quarter of 2015 the gap stood at 4.3per cent. By the final quarter of 2015, the gap had widened to 7 per cent. The gap in the current account is larger than it has been since 1955. The Bank believes that the deterioration is due to a shortfall in net payments of foreign direct investment and portfolio investment.

British banks, including The Bank of Scotland have been withdrawing from overseas investment scaling back the income flows to Britain. At the same time, the collapse in commodity prices has mean that firms such as RTZ, Shell and BP have seen their income hit. The sell-off of British multinationals to foreign companies has seen overseas earnings being brought back to Britain reduced. The profits of ICI, Carlsberg, Boots, Scottish and Newcastle and Cadbury no longer land on British shores to boost NPIA. The strong pound and higher growth rates in the UK have helped to bolster inward investment and make up the shortfall.

Exit from Europe could affect the flow of inward investment and cause the UK government to focus on the underlying weakness of Britain’s Current Account. Time will tell.