Will the Living Wage Cost Jobs?

The government wants to move from a low wage, high tax, high welfare society to a higher wage, lower tax, lower welfare society.

With record employment, the highest GDP growth in the G7, over 2 million jobs created since 2010, and 1.1 million more forecast by the Office for Budget Responsibility (OBR), the government believes that now is the right time to take action to ensure low wage workers can take a greater share of the gains from growth. From April 2016, the government will introduce a new mandatory national living wage (NLW) for workers aged 25 and above, initially set at £7.20 – a rise of 50p relative to the current National Minimum Wage (NMW) rate. That’s a £910 per annum increase in earnings for a full-time worker on the current NMW. Source: www.Gov.uk

The new national living wage is an essential part of this. It ensures that work pays, and reduces reliance on the state topping up wages through the benefits system.

JD Wetherspoon has put 34 pubs, valued at £40million up for sale There is speculation that this is in response to the imminent introduction of the ‘living wage’ The sale is the biggest sell-off by Wetherspoon’s since it was founded 36 years ago. The sell-off means that for the first time ever, Wetherspoon’s will have fewer pubs at the end of the year, than it started with.

Analysts said that the disposals were confirmation by Wetherspoons that its tail of bottom-end pubs needed urgent weeding amid falling margins.

Chairman Tim Martin has been a vocal opponent of the National Living Wage. He commented that, ‘Increased labour costs are clearly an important factor for all pub and restaurant companies and may result in our annual profits being slightly lower than the last financial year.’

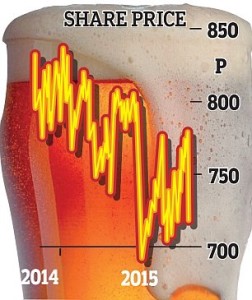

In September, 2015 Wetherspoon announced a fall in pre-tax profits from £79.4 in 2014 to £58.7million. Rising staff costs are likely to increase downward pressure on profits. The news is likely to put pressure on Wetherspoon’s share price.

The introduction of the National Living Wage from April 2016 will push wages costs for staff aged over 25 to at least £7.20 an hour. Wages will rise to £9 by 2020. Analysts believe that the rising wage bill could cause problems for many pubs and could accelerate the rate of pub closures.

At present staff costs make up a significant proportion of Wetherspoon’s overheads. Staff costs account for 25 per cent, or 75p, of every pint sold for an average of £3 in pubs.

John Cridland, the outgoing head of the CBI believes that the “national living wage” is a gamble and could cause problems for firms that employed large numbers of low-paid staff. He believes that the measure, intended to increase wages by 3% per year until 2020 could have unintended consequences. One of these consequences could be a “labour light” service sector as companies replace workers with machines.

Task

Using appropriate diagrams consider the impact of the Living Wage on employment in:

a) the service sector

b) the uk economy as a whole.