Supply Side Policies – Two Conflicting Viewpoints

28th September 2015

“Supply-side economics” describes how the changes in marginal tax rates can affect economic activity. Supply-side economists believe high marginal tax rates have an adverse effect upon income, output, and the efficiency of resource use.

The marginal tax rate is seen as an important influence on the incentive to work since it influences the incentive to earn. The marginal tax rate determines how much of an individuals income must be paid to the government in taxation and what proportion will be left for the individual to spend or save. If, for example the marginal rate is 50 percent, the fifty per cent of every hundred pounds must be paid to the Exchequer in tax. the individual will be left with only fifty pounds to spend. As the marginal tax rates increases, individuals are left with less of their income and may therefore feel less inclined to work, as the benefits from working are reduced.

The marginal tax rate determines how much of an individuals income must be paid to the government in taxation and what proportion will be left for the individual to spend or save. If, for example the marginal rate is 50 percent, the fifty per cent of every hundred pounds must be paid to the Exchequer in tax. the individual will be left with only fifty pounds to spend. As the marginal tax rates increases, individuals are left with less of their income and may therefore feel less inclined to work, as the benefits from working are reduced.

The benefits of Supply side polcies are claimed to be:

1. Lower Inflation.

2. Lower Unemployment

3. Improved economic growth

4. Improved trade and Balance of Payments.

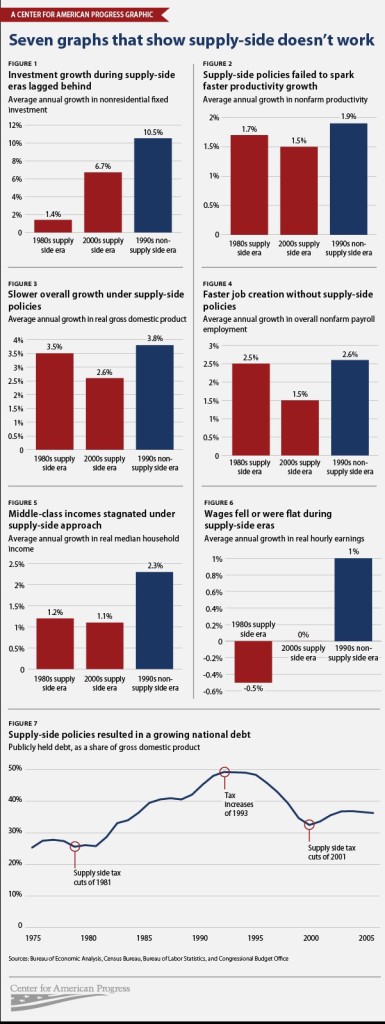

Whether supply side policies work is a matter of intense debate. The graphs below suggest that American experience of Supply side policies has not led to growth or improved economic efficiency.

The arguments for and against Supply side policies are summarised below.

| Supply side economists | Interventionist economists |

|---|---|

| free markets promote economic efficiency | Free markets may fail to maximise economic efficiency in the economy |

| Government intervention damages economic efficiency | Governments have a responsibility to correct market failure |

| The government role should be to ensure a business environment which allows free markets to operate. | Data suggests that the trickle down effect does not work |

| Supply side economists believe that governments have a responsibility to remove barriers which prevent markets from working perfectly | Estimates of the elasticity of labour supply indicate that a 10 percent change in after-tax wages increases the quantity of labour supplied by only 1 or 2 percent. |

Supply side policies are not limited to adjusting the marginal rate of taxation. In the UK the following measures have been adopted:

Supply Side Measures Used in the UK

| Privatisation. | Lower Income Taxes. |

| Increased education and training | Deregulation |

| Lower Income Taxes. | Improved information about jobs |

| Deregulation of financial markets | Removing unnecessary red tape and bureaucracy |

| Improving Transport and infrastructure. | Deregulation of Labour Markets |

0 Comments