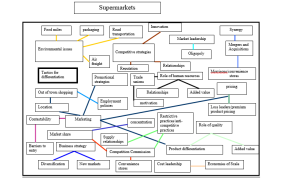

Investigations into the food retail market can cover a broad range of areas. The mind map serves to highlights significant issues which should be considered in an investigation of the food retail market. It is not intended that this map should be definitive, rather that it highlights and exemplifies relationships and illustrates how points of interest may be investigated.

Environmental issues:

Environmental issues are an important consideration and a number of pressure groups have sought to highlight the damaging effect of long distance food sourcing. It is clear that the impacts are felt by local producers and wholesalers. Overseas producers in developing countries are also affected. Food production and flower in countries such as Kenya bring positive and negative externalities. Positive externalities include employment and export revenues. Negative externalities extend to deforestation, nutrient depletion and soil erosion.

Of growing concern to environmental pressure groups is the impact that transporting food long distances is having on the environment. Food shipment is seen as an important and growing contributor to global warming.

The shipment of goods within the UK to processing and regional distribution centres is exacerbating the problem. Goods are being shipped long distances only to be sold within a few miles of where they were produced. Supermarkets do not have to internalise the negative externalities of food shipment and trans-shipment. For supermarkets shipping an apple four thousand miles makes perfect economic sense.

The development of national distribution systems has increased traffic congestion and results in wear and tear on roads.

Food packaging helps to protect food and make appealing to customers but the environmental cost (production and disposal) is significant.

Competitive advantage:

The food retail market is extremely competitive. Firms have sought to develop distinct sources of competitive advantage. Sources of competitive advantage extend beyond those traditionally identified in the course text. Nonetheless, innovation, reputation and relationships are an important starting point for investigation and revision. Supermarkets have sought to innovate by expanding the size of store formats and increasing the range of products offered. They have also sought to move away from just offering food and have moved into clothing, electrical and financial services. The advantage of these sectors is that they typically offer higher profit margins than the food retail sector.

Firms within the food retail sector have worked hard to build reputation. Tesco for example has engaged in community projects such as ‘Computers for schools’ whilst Sainsbury has sought to highlight quality. For some stores reputation can become a millstone. Kwiksave, the mid-priced retailer, fell foul of consumers benefiting from rising disposable incomes who wanted a few frills with their foods. Kwiksave had built its reputation on not offering ‘frills.’ The entry of truly low cost retailers such as Aldi and Lidl heightened Kwiksave’s problems and led to the merger with Somerfield.

Relationships are an important aspect of the food retail market. Supermarkets seek to build relationships with a range of stakeholders. Relationships with staff are an important part of ensuring customer service. Motivation theory can be applied to an examination of the relationship between supermarkets and employees. Remember examiners are looking for candidates to support arguments with economic and business theory. Commonsense answers will not be good enough to ensure a high grade. Pay and conditions are factors which will affect the quality of staff recruited and the quality of customer service offered. The decision by Tesco to cut sickness benefit paid to staff could have unforeseen consequences and may not necessarily improve customer service or, customers shopping experience. Staff training and effective customer service can increase productivity and add value.

Oligopoly

The supermarket sector is an oligopoly. The four firm concentration ratio is often used in order to define an oligopoly. An oligopoly is said to exist when the four firm concentration ratio is above 0.4. The four firm concentration ratio in the supermarket sector is more than 0.7.

An oligopoly occurs when a market is dominated by a small number of sellers. This does not mean that there are only a few large retailers. In fact there are a large number of retailers in the UK food market, just that a few large firms are able to exercise control over the market. As there are only a few large retailers, each oligopolist is aware of the actions of the others in the market. Oligopolistic markets such as the food retail sector are interactive. The decisions of one retailer influences, and is influenced by, the decisions of another retailer.

The strategic decisions of the leading supermarkets will take into account the likely responses of other market participants. Safeways for example, knew that competitors would seek to follow suit if they used price promotions. In order to prevent this they delayed sending out mailshots detailing price promotions until the end of the week. By doing this they knew that their leading rivals would be unable to get stock delivered in store to match demand for the promotion items and that customers of rival stores would be disappointed, even though their competitors gave a price match promise. Interdependence between firms in an oligopolistic market, means the food retailers must take into account the likely reactions of other firms in the food market when making pricing and investment decisions. This creates uncertainty. Candidates may choose to use game theory in order to model this.

Firms within an oligopoly produce or supply branded products and services. Advertising, marketing and promotion is an important feature of competition in this type of market. Barriers to entry do exist in an oligopolistic market and this needs to be considered when examining the food retail market. Barriers to entry may enable firms in the market to make abnormal profits in the long run.

Consideration should be given to the pricing strategies used in oligopolies in general, and the pricing decisions employed within the food retail sector, in particular.

There are four major theories about oligopoly pricing:

- Retailers may collaborate to charge a monopoly price and get monopoly profits

- Retailers may compete on price so that price and profits will be the same as a competitive industry

- Retailers prices and profits may be between the monopoly and competitive ends of the scale

- Retailers prices and profits may be “indeterminate” because of the difficulties in modelling interdependent price and output decisions

- When one retailer (e.g. Tesco) has a dominant position in the market the oligopoly may experience price leadership.

Food retailers with lower market shares may simply follow the pricing changes prompted by the dominant firm.

Non-price competition:

Non-price competition is widely used in oligopolistic markets, relying on a range of strategies other than price, for increasing market share. Consider the example of the highly competitive UK supermarket industry where non-price competition has become very important in the battle for sales:

- Mass media advertising and marketing

- Store Loyalty cards

- Banking and other Financial Services (including travel insurance)

- In-store chemists / post offices / creches

- Home delivery systems

- Discounted petrol at hyper-markets

- Extension of opening hours (24 hour shopping in many stores)

- Innovative use of technology for shoppers including self-scanning machines

- Financial incentives to shop at off-peak times

- Internet shopping for customers

Non-price competition is a way for supermarkets to add value and differentiate themselves.

Barriers to entry:

The capacity to gain and retain market share is important. Partnerships and innovative solutions can be used to gain market share. Customer service and continuous product enhancement can be used. The leading supermarkets ensure that they receive effective and continuous feedback from their customers. Detailed competitive analysis is also used and their has been an increasing trend towards addressing the growing fragmentation of customer tastes and preferences. All of these strategies can be used to attract and retain customers.

Tesco has sought to use strategic alliances when entering overseas markets. Its entry into the Chinese food market was achieved by means of a strategic alliance with a Chinese partner. A properly structured strategic alliance can save time and resources allowing Tesco and its to focus on what they do best. Strategic alliances are a marriage of interests that should be entered into carefully and can provide partners with a competitive advantage. Unfortunately, these partnerships have not proved as successful as first hoped. This has led to Tesco exiting the Chinese market.

Key questions which need to be answered when forming a strategic alliance:

• Who are your potential allies?

• What are you sacrificing by entering an alliance?

• Are you entering the alliance simply to prevent someone else from doing so?

• Will the alliance serve your immediate goals?

Other barriers to entry include:

Patents

Giving the firm the legal protection to produce a patented product for a number of years

Limit Pricing

Firms may adopt predatory pricing policies by lowering prices to a level that would force any new entrants to operate at a loss. When Aldi entered the UK market a price war ensued with tine of baked beans being sold a 1p a tin and 7p a loaf for bread.

Cost advantages

Lower costs, perhaps through experience of being in the market for some time and the exploitation of economies of scale may enable existing food retailers to cut prices and win price wars

Advertising and marketing

Marketing expenditure in order to build consumer loyalty and establish branded products can make entry into the market by new firms expensive.

Research and Development expenditure

High research and development can act as a deterrent to potential entrants to an industry.

Sunk Costs

When sunk costs are high, a market becomes less contestable. Sunk costs act as a barrier to entry for new firms.

Out of town shopping:

Supermarkets moved out of town centres during the 1980s and 1990s. This has created a number of problems. Supermarkets attract customers into the area. Other retailers benefit from supermarket customers. When stores move out of town many independent retailers find that their customers go with them. This has led to the ‘death’ of many high streets, leading to urban decay and a reduction in the number and range of stores remaining. Deterioration of the urban fabric may be a consequence of supermarkets moving out of town. Those on low income and the elderly may find that they have difficulty in getting to food shops. Town planners can reverse this trend but the cost of rejuvenating town centres may be high.

Convenience stores:

Convenience stores are the new growth sector. Supermarket growth may be difficult to sustain in the long term. Tesco and Sainsbury have recognised this and have bought up convenience stores. The convenience store sector is growing much more quickly and the cost of individual units is comparatively low. A further consideration is that convenience stores are less likely to fall foul of planning regulation and may offer higher profit margins.

Diversfication

Diversification was at the core of Tesco’s strategy. The company has diversified into new markets, new products and new types of outlet (real and virtual). This strategy has caused problems for the company in recent years. Expansion into America caused problems. Its Turkish subsidiary has encountered problems and its Japanese stores were sold at a loss.

Tesco and other retailers have expanded their product range to clothing and other non-food items. This led to the build of a growing number of hypermarkets. The recent change in consumer shopping trends has made thes stores unsuited to the current market. Supermarkets are now reviewing their property portfolio. Tesco has been forced to mothballs brand news stores which have never seen a single customer.

While the big four have struggled, budget retailers such as Aldi and Lidl have encountered considerable success extending their low price, narrow range format to a number of countries.

Mergers and acquisitions

Mergers and acquisitions may offer potential benefits for firms in the food retail sector. Mergers can provide short term growth for a business and may enable firms to benefit from sharing and rationalising resources. This may give rise to synergistic benefits. Merged organisations may be able to benefit from various types of economies of scale. Purchasing, marketing, distribution and risk economies of scale may all be achieved. The downside of mergers is that they may give rise to a culture clash – this was evident in the difficulty which Morrisons experienced in trying to integrate Safeway into its organisation.

The Competition and Markets Authority

Competition and Markets Authority has powers to investigate whether a proposed merger is in the public interest. A monopoly exists if a firm has more than 25% of the market. The Authority can recommend that a merger or acquisition is prohibited.

The Competition and Markets Authority may also investigate anti-competitive practices. Powers exist to fine companies up to 10% of turnover for breaches of regulations.

Anti-competitive practices include:

- Price Fixing where competitors agree to charge the same or similar prices.

- Market Sharing which occurs when competitors agree to restrict territories, customers or business operators.

- Boycotts or actions taken by two or more competitors to prevent another from acquiring or receiving goods and services.

- Misuse of Market Power to damage or eliminate a competitor.

- Exclusive Dealing where arrangements are made to restrict a business in purchasing or supplying goods or services.

- Refusal to Supply goods or services.

- Resale Price Maintenance or the setting of minimum prices by suppliers to prevent businesses from discounting.

Practice Questions

The following questions should give you an opportunity to prepare practice responses to questions which focus on the food retail market. Taking time to practice questions and plan responses is time well spent. Getting exam technique right is vital to success when sitting paper 6364. Time is tight and the demands of the paper, particularly the 40 market question, mean that thorough preparation is essential. Successful applicants will be required to demonstrate understanding and application of a wide range of economic and business concepts. The 40 mark question will require candidates to apply knowledge, demonstrate analysis and evaluate in order to reach balanced conclusions.

- Explain how exploiting economies of scale may benefit firms in the food market

- Examine the impact of supermarkets moving to out of town locations on two stakeholder groups 1. Examine the benefits of supermarkets entering into joint ventures.

- Assess the importance of branding to supermarkets.

- Examine the implication of local food sourcing for two different stakeholder groups.

- Explain how local sourcing may provide a source of competitive advantage.

- Examine the possible impact of price elasticity of demand on the sale of locally produced goods.

- How might producers persuade supermarkets to stock their products?

- Examine the implications of sourcing products from developing countries

- Assess the extent to which competitive pricing is used by supermarkets.

- Examine the motives behind acquisitions and mergers in the food retail sector.

- Explain two strategies which FOE might adopt in order to influence the activities of firms in the food sector

- Evaluate two possible ways that Tesco might adopt in order to expand its market share.