Start Here: Market Structures

21st September 2015

You could look at the mobile phones market, the Banking Sector or the Oil market – to cite just three markets dominated by the competition of the few, or oligopoly (defined as 3-5 sellers). Concentration ratios measure the level of concentration in different sectors.

Competition, in truth, exist on a spectrum – on one side, Perfect Competition as a model of productive (least cost) efficiency and allocative efficiency (which maximises benefit to the consumer). On the other side, Monopoly, or the single seller. Between them we have oligopoly and monopolistic competition – two further models of how firms behave in the modern era. But is perfect competition really that perfect (and given it only really applies to homogeneous products such as fruit and veg, is it really that relevant)?

And given that the Government, before the privatisation era which began in 1984, has run state monopolies (gas, electricity, rail), is monopoly really that bad? And what do we make of the newly named Competition and Markets Authority? Are they doing a good job in protecting the interest of consumers (for low price, good quality and wide choice)?

In this section we examine and evaluate different theories of the firm which yield different markets structures, from the highly competitive to the monopolistic single seller. We’ll post any news of merger activity (eg the beer market in September 2015) in the Extracts section above.

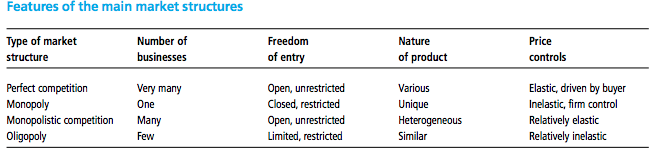

All the while remembering the eternal economic truth: both producers and consumers make decisions at the margin, driven by ideas of rational behaviour (core concept 3). Below is a summary of the different types of market structure. You may notice one misprint – perfect competition has homogeneous products, not various, and where the table talks of ‘price controls’ we would normally refer to ‘price elasticity‘.

0 Comments