What is an Oligopoly?

Oligopoly can be defined as a market in which there are few suppliers and many buyers.

The above definition raises the question as to what comnstitutes a few. In an oligopoly there will be suffieciently few firms so that each seller will need to consider the actions and reactions of the competitors in the market when assessing the impact of any decisions which it takes. In other words, in oligopolistic markets interdependence is important in oligopolistic markets.

Oligopolies in the UK

Think of ten products that you buy or might like to buy. Then, think of the firms that supply those products. Most if not all of the products that you identify will be supplied by firms who operate in oligoplistic markets. Oligopoly, is particularly common amongst manufacturing firms; in transport; energy; wholesaling and retailing. In the majority of these sectors there has been a tendency for the degree of oligopoly to increase. Some attempt has been made by the Competition Commission and its successor the Competition and Markets Authority to reverse the trend. The best example of this is the emergence of challenger banks.

The High Street has seen the appearance of a number of new banks which are threatening the stranglehold of the major ‘Big Four’ banks. Newcomer such as Metro Bank, Virgin Money and Clydesdale are trying to break the stranglehold of the major high street banks and have their sights on seizing market share and customers from the established high-street lenders.

Metro Bank were the first bank to recieve a new banking licence to operate on the high street for more than 100 years, in 2010. More than a dozen new banks have sprung up since then.

Measuring the degree of competition

The degree of oligopoly is measured using concentration ratios. Concentration ratios measure the percentage of an industry’s output controlled by the largest few firms. For example, a three firm concentration ratio would measure the share of output controlled by the three lagest firms.

The concentration ratios for a number of markets is shown below:

Supermarkets

Why are oligopolies so common?

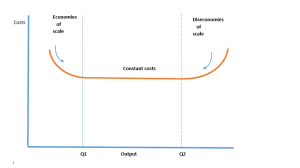

The diagram above illustartes that the long run average cost (LRAC) curve reaches a minimum at Q1. Beyond this point LRAC remains constant before rising after Q2. Q1 represents the minumum efficient scale (MES) for the firm. At Q1 cost per unit of output have reached a minimum. Any firm which has a lower output will be at a cost disadvantage. The existence of an MES explains the relatively high incidence of oligopolies in the manufacturing sector.

Barriers to Entry

Once an oligopoly is established it may be maintained by the presence of barriers to entry. Barriers to entry make it difficult for new firms to enter the market and become established. The barriers may occur as a result of production economies of scale. New entrants to the market may not be able to afford the machinery or other equipment needed to be cost competitive.

Existing firms may have established considerable consumer loyalty. This consumer loyalty may have been built up through marketing branded products. New firms may lack the ability to invest heavily in advertising to overcome consumer preference for existing products.

The existence of patents may give existing firms a competitive advantage. In some industries technological innovation may erode the competitive advantage of existing firms and nullify the benefit of economies of scale that existing firms may have. Mobile phone companies were able to enter the communications market and compete with BT because they did not need to invest in expensive infrastructure. By using wireless masts they could do without an expensive network of cables and exchanges. Government regulation has allowed new firms to compete with BT by forcing BT to allow rival firms to use its cable network.

New technology in the newspaper industry allowed newspapers to launch and to compete with relatively low circulations. The internet has opened up new opportunities for online newspapers to launch and compete for advertising revenues. The expansion of digital broadcasting has led to a proliferation of tv channels. It is a matter for debate whether this change has led to a maintenance of quality as the television audience has become increasingly fragmented.

The behaviour of firms in an oligopoly

Firms in an oligopolistic market are interdependent. Firms recognise that consumers have choices and that if a rival firm was to raise its prices then consumers may choose to buy an alternative product at a lower price. A reduction in price by another firm may lead to it attracting customers from rival firms. What consumers do in practice will depend upon how rivals firms react. For economists, the degree of interdependence of firms creates an element of uncertainty. In monopoly situations, it can be predicted with a degree of certainty that a reduction in proce may be expected to result in an increase in demand. In oligopolistic markets, there is a lack of certainty. Firms must develop strategies to cope with the level of uncertainty in the market. One option is to decide whether to co-operate with rival firms. Co-operation can remove uncertainty. In the UK, co-operation in the form of cartels is not allowed. A cartel is an agreement between competing firms to control prices or exclude entry of a new competitor in a market. Firms in a cartel act together as a monopolist. By co-operating, firms in a cartel are able to agree a price and output levels that maximise total group profits. Market share is allocated between cartel members on an agreed basis..

Firms may opt to collude. Collusion is less formal and is harder to detect.

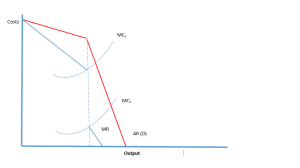

Sweezy’s Kinked Demand Curve offers one model how firms in oligpolistic markets may react.The assumption is that oligopolists will be concerned with maintaining market share. If one firms cuts their price, rival firms will follow suit. As a result, the only extra customers gained will be new customers to the market who are attracted by the lower prices. If a firm increases its price, rivals will maintain their price in order to attract customers who are put off by the original firm’s price rise. As a result of the reaction of firms the demand curve will be kinked. A price reduction will lead to an inelastic demand curve. A price rise will lead to an elastic demand curve. The kinked demand curve will lead to ‘sticky prices.’ In this scenario it makes sense for firms to compete through advertising, rather than by competing on price.

Prisoners Dilemma

Game theory centres on the prediction of what will happen in games of strategy. Game theory has widespread applications. It helps to explain situations where the participants do not have complete knowledge of the others participants intentions

Game theory is useful in understanding the behaviour of firms in oligopolistic markets.

The Prisoners’ Dilemma

The classic illustration of how game theory works is the ‘prisoners dilemma.’ Two individuals have been arrested for a violent crime. They are held separately and questioned. The prisoners have two choices. They can stay silent. Providing both prisoners do this they are likely to go free. If however one confesses and incriminates the other, the person confessing is likely to get a reduced sentence. The second prisoner will face a more severe sentence.

If both prisoners decide to confess they will both go to prison but will both receive some reduction of their sentence.

What to do?

|

Both stay silent Both go free

|

Both confess

Both get a reduced sentence (5 years) |

| Prisoner 1 confesses and gets a reduced sentence (3 years)

Prisoner 2 stays silent and gets a severe sentence (10 years) |

Prisoner 1 stays silent and gets a severe sentence (10 years) Prisoner 2 confesses and gets a reduced sentence (3 years)

|

If they can both trust each other, they can both go free. However, they are not able to communicate. The choice of confessing will bring a reduction in sentence regardless of whether one or both confess.

The worst case scenario is to stay silent and let the other prisoner make a deal. The temptation is to take the least worst option and confess.

This scenario allows us to understand how interdependence can affect decision making.

In the real world competition authorities use the prisoners dilemma to offer incentives to members of cartels and price rings to confess in return for uimmunity from sanctions. Guess what it actually works! Nine french yoghurt producers were fined a total of 193 million euros for price fixing. Yoplait received no fines because it gave evidence to the regulator.