Handout: Determinants of Investment

7th September 2015

Determinants of Investment

The Institute of fiscal studies defines investment as, ‘spending on fixed assets. These are defined as assets that last for more than one year. Government departments use this definition in their annual budgets to distinguish between items of spending such as wages (known as current spending) and items such as buildings, vehicles and machinery, from which benefits can be derived in future years (known as capital spending).

There are two components of investment: spending on new fixed assets and spending to replace and/or repair existing fixed assets. The former is net investment; the latter is investment to offset depreciation. Depreciation is the value that items lose as they age and suffer from ‘wear and tear’.

Gross investment is the sum of net investment and investment to offset depreciation.

Investment is determined as expenditure on new plant and capital equipment and in stock. Investment decision are based upon highly variable and subjective estimates of the economic future.

Factors influencing expectations

- Interest rates affect planned investment. Firms will be more likely to increase investment if they believe that interest rates are likely to remain low for the foreseeable future. Conversely, if there is an expectation that interest rates may rise in the immediate future, then firms may postpone investment decisions, as the net return on investment projects is reduced by increased borrowing costs.

- The consumption function which can be related the level of real disposable income will affect the level of investment.

- If demand increases in the economy, then the return at any given rate of interest may be expected to increase. Therefore, at any given interest rate, more investment is likely to take place. The effect of this would be to shift the marginal efficiency of capital (MEC) to the right.

- The Investment-Growth Relationship

- There tends to be a positive relationship between the level of investment and economic growth.

As Investment  Economic growth also

Economic growth also

Beyond a certain point, as investment increases, the rate at which output increases will diminish. This is because the returns on investment will experience diminishing marginal returns.

The law of diminishing marginal returns

Assuming Ceteris Paribus; that as more and more investment is directed towards and already large stock of capital, marginal productivity of capital will diminish.

Real investment

Not all investment will be new investment intended to increase productive capacity. Some investment will go towards replacement of worn-out factories and obsolete machinery. A mature economy will have to pay a higher proportion of its investment towards meeting depreciation, than a less developed economy which will tend to pay a much lower percentage of investment towards covering depreciation of existing resources. Therefore when considering levels of investment, we need to consider net investment, rather than gross investment.

The quality of investment

Not all investment achieves the same return. Some investment yields a high return. Other investment may be less successful and lead to a much lower return on capital. The way in which investment is utilised may affect the capital/output ratio. For example, comparable levels of investment in German and UK industries have resulted in higher levels of productivity in Germany than in the UK. Consideration should therefore be given to the quality of investment.

Willingness to invest

The willingness of a country to invest in increasing its productive potential will depend upon a number of variables:

In the private sector, difficulty in obtaining new share capital or, gaining access to long-term loans will affect a firm’s ability to invest.

Corporate taxation will reduce the internal funds available for investment and reduce net profit after tax. High rates of corporate tax may lead to a reluctance to invest in the business and decision to postpone investment in order to maintain dividends to shareholders.

As with Income, there are two things that firms can do with profit. They can spend profit or they can reinvest it, in order to increase productive capacity. Hopefully, this will lead to higher sales and increased profitability.

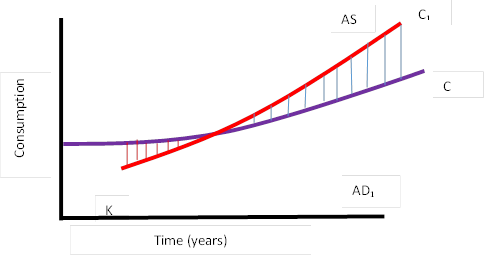

The economy as a whole has to make the same decisions regarding spending or saving available. Increasing investment may lead to a short term reduction in living standards, but in the long term may lead to higher living standards. This is illustrated in the diagram below:

The impact of deferred consumption and increased investment

The growth path (C1) shows the result of reducing immediate consumption and investing in fixed capital formation. The long term benefits of a short term reduction in consumption, may be higher living standards in the long term.

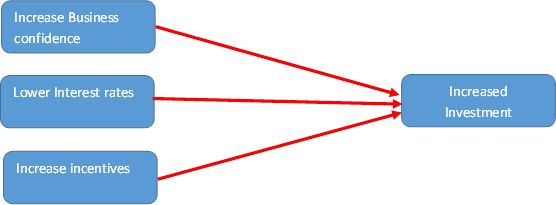

What can be done to increase private sector investment?

Increased public sector investment

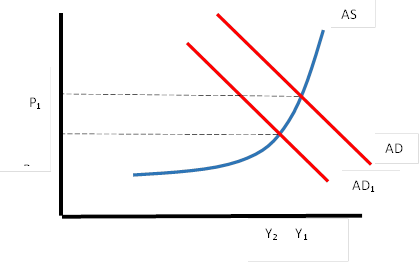

Public Sector Investment can have a significant impact upon capital formation. Public Sector investment has fluctuated significantly over time, influenced to a large extent by changes in government and changes in public policy. For example, public sector investment public sector investment was cut back between 1979 – 1989. After 1989, public sector investment rose. Since then net public sector investment has fluctuated, although it has remained below the levels of investment seen in the 1960’s and 1970’s. Public sector investment fell from 3.5% of GDP in 2008 to 1.5% in 2011. The effect of such a reduction, and the current government’s tight budgetary controls are likely to reduce aggregate demand, lower economic growth and have an adverse effect on employment.

A fall in government investment is likely to reduce aggregate demand

Government spending on capital investment projects such as new schools, new roads and other infrastructure investment have a multiplier effect. The Royal Institute of Chartered Surveyors estimates that spending on construction projects has a multiplier effect of 2.4. Reducing expenditure on road building, schools and hospitals is likely to have a downward multiplier effect.

The Link between Investment and Saving

Capital accumulation can depend on the level of savings, therefore increased investment would require increased saving. Potentially, it could be possible to increase the growth rate by increasing the rate of saving in the UK (providing the additional savings led to the production of additional capital goods).

The correlation between savings and economic growth is illustrated by the experience of Japan during the 1960’s and 1970’s, where savings rates outstripped those of the UK, consequently the average annual rate of real growth in Japan was more than double that of the UK.

In the UK, successive governments have introduced measures such as tax breaks to encourage wider share ownership and increase savings.

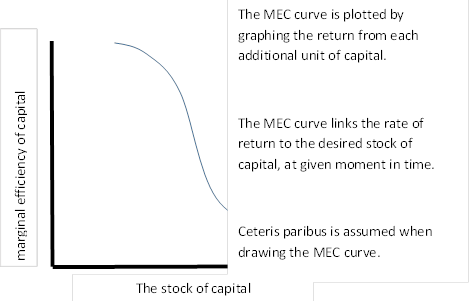

Marginal efficiency of capital

Marginal efficiency of capital was a concept developed by John Maynard Keynes. The marginal efficiency of capital refers to the anticipated rates of return on investment as additional units of investment over a given period of time.

A comparison of these rates of return with the current rate of interest can be used to gauge the profitability of investment.

Marginal efficiency of capital – the rate of return on the last unit of capital employed

As the quantity of investment increases, the rates of return from it may be expected to decrease. This is because the most profitable projects are likely to be undertake first. Continuing investment will consist of projects with progressively lower rates of return.

It is logical to assume that investment would be undertaken while the marginal efficiency of each additional unit of exceeds the interest rate. Investment is profitable while the marginal efficiency of each additional exceeds the interest rate. If the interest rate were higher than the marginal efficiency of capital, the cost of borrowing would be greater than the return on the investment. It does not matter whether borrowing was necessary for a project, what is decisive is that greater returns could be achieved by lending out the funds available at the current rate of interest.

Marginal efficiency of capital was a concept developed by John Maynard Keynes. The marginal efficiency of capital refers to the anticipated rates of return on investment as additional units of investment over a given period of time.

A comparison of these rates of return with the current rate of interest can be used to gauge the profitability of investment.

As the quantity of investment increases, the rates of return from it may be expected to decrease. This is because the most profitable projects are likely to be undertake first. Continuing investment will consist of projects with progressively lower rates of return.

It is logical to assume that investment would be undertaken while the marginal efficiency of each additional unit of exceeds the interest rate. Investment is profitable while the marginal efficiency of each additional exceeds the interest rate. If the interest rate were higher than the marginal efficiency of capital, the cost of borrowing would be greater than the return on the investment. It does not matter whether borrowing was necessary for a project, what is decisive is that greater returns could be achieved by lending out the funds available at the current rate of interest.

| Scenario

A firm may choose to accumulate more capital in relation to other factors of production such as land and labour. For example, a firm may increase is stock of capital so that each employee has 2x as much capital to work with as previously. This would be an example of capital deepening. Capital deepening describes the downward sweep of the MEC curve. If the assumption is made that technology is constant as more capital is added to a constant quantity of other factors of production, then the law of diminishing marginal returns will apply. |

0 Comments