Government targets (Aggregate Expenditure)

by

5th September 2015

Summary of Government Targets

Source: EI Economic Review 2014-15 by Peter Baron

- CACB The Government’s ‘fiscal mandate’ requires it to balance the cyclically-adjusted current budget (CACB) – the amount the Government has to borrow to finance non- investment spending, adjusted for the state of the economy – five years ahead. In December, we forecast that the CACB would be in surplus by 1.6 per cent of GDP in 2018-19. We now forecast the surplus in 2018-19 to be 1.5 per cent of GDP.

- PSNB The Government’s supplementary target is for public sector net debt (PSND) to fall as a share of GDP in 2015-16. We now expect PSND to peak at 78.7 per cent of GDP in 2015-16, to fall by a small margin in 2016-17 and then to fall more rapidly to 74.2 per cent of GDP by 2018-19. Debt as a share of GDP is lower in each year of our forecast than in December, reflecting lower borrowing and upward revisions to our nominal GDP forecast.

- CPI The Government, via the Monetary Policy Committee, has a set a target of 2% inflation. If the target is missed, as it was in December 2014, then the Governor of the Bank of England writes a letter to the Chancellor explaining the missed target. Inflation was 1.5% below target in 2014.

4. Unemployment The Government has a target of 7% unemployment. The March 2014 forecast of 6.8% proved inaccurate as, again, unemployment fell further and more quickly than expected to 5.5%. Unemployment is an approximate measure of the state of demand.

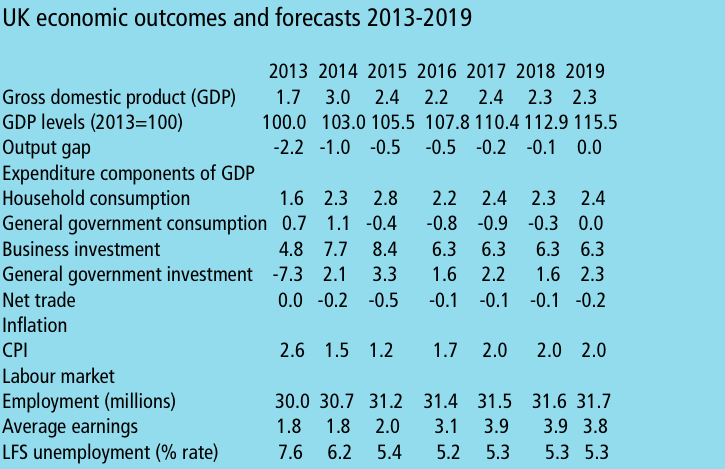

UK economic outcomes and forecasts 2013-2019

0 Comments