Economic Cost and Normal Profit

6th October 2015

Economic Costs and Normal Profit

A firm’s “accounting costs” are all the financial costs it incurs to produce a level of output.

We make a distinction in Economics between fixed and variable costs. Variable costs vary with the level of production – we use more electricity and raw materials to produce more cars, whereas rent and insurance is a fixed cost that remains unchanged with output. Labour may be either fixed (management) or variable (workers’ overtime).

A firm’s “economic costs” include the firm’s accounting costs as well as opportunity costs. Opportunity costs are implicit costs because no payment is required, but simply represents what is forgone in doing a particular thing.

For a car manufacturer, the economic cost of producing cars includes all of the accounting costs listed above, as well as the opportunity cost of producing cars (e.g., the profit that the firm could have earned by producing the next-most-profitable use of the firm’s resources). A firm’s “economic profit” (or loss) is equal to the firm’s revenue, minus the firm’s economic costs.

The concept of economic profit is crucial because firms make decisions based on economic profits rather than accounting profits. Firms are assumed to be rational profit-maximisers, who want to maximize their economic profits rather than accounting profits. Since our focus is economics and not accounting, we use the term “costs” to mean “economic costs” (which include all opportunity costs) and “profit” to mean “economic profit”.

Ford UK knows that by making cars they can bring in £100,000,000 of revenue per year, with £6,000,000 of accounting costs. In other words, by making cars, Ford can earn an accounting profit of £4,000,000 per year.

Given these facts, does it make sense for Ford to stay in the car business? We have no way of knowing the answer unless we also know how much Ford could earn by doing something else.

If Ford could earn £5,000,000 per year in accounting profit making vans, they would be losing (forgoing) £1,000,000 per year by making cars. In other words, the fact that Ford could generate an accounting profit of £4,000,000 is not a sufficient reason for them to remain in the car business. If Ford is only concerned with maximizing their economic profit, their car business would actually incur an economic loss of £1,000,000. (Overall, Ford is £1,000,000 worse-off by making cars compared with vans)

Average Total Costs

A firm’s “average total cost” is simply its total costs (AFC + AFC), divided by the number of units produced. Average total cost (AC) is an important concept because a firm cannot earn an economic profit selling a good unless its unit price is above average total cost. For example, if Ford incurs costs of £600,000 in a given month and produces 100 cars that month, the firm’s average total cost is £6,000 (AC / Q). If the price of a car is above £6,000 Ford will earn a profit. Otherwise, it will not.

How to Calculate Economic Profit (or Loss)

At any given point of production, total revenue (TR) is equal to the market price (P), multiplied by the quantity sold (Q). That is:

TR = P × Q.

And at any given level of production, total costs (TC) are equal to the average total cost of production (AC) multiplied by the quantity produced (Q). That is:

TC = AC × Q. (Remember, AC is TC ÷ Q.)

So when producing at quantity Q, economic profit (or loss, if negative) will be calculated as:

Profit = (P × Q) – (AC × Q), or

Profit = (P – AC) × Q.

If the market price (P) is greater than average total cost (AC) at quantity Q, the company will earn a positive profit (i.e., the expression above will be positive). If average total cost at quantity Q exceeds the market price, the firm will incur a negative profit (i.e., a loss, because the expression will be negative).

Normal and supernormal profit

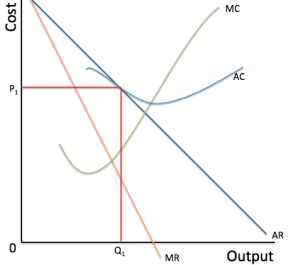

Normal profit is the level of profit required to cover all opportunity costs and so stay in business in the long run. At normal profit output, economic profit equals zero. In the diagram, the firm is just making normal profits in producing at the output where AC = AR (remember AR = price).

stay in business in the long run. At normal profit output, economic profit equals zero. In the diagram, the firm is just making normal profits in producing at the output where AC = AR (remember AR = price).

Supernormal profit is where AR (price) > AC – or profits above all opportunity costs are earned.

The prediction of the theory of the firm is that perfectly competitive firms earn only normal profits in the long run, when new firms can enter the industry. However, due to barriers to entry, monopolists can continue to earn supernormal profits in the long run.

0 Comments