Core Concept 3: Rationality

21st September 2015

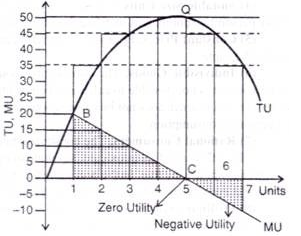

Classical economic theory assumes a certain model of rationality: that utility-maximising consumers interact with profit  maximising producers. We call this rational choice theory. Consumers consume a product until the marginal utility of the last unit consumed equals zero – on a graph, the marginal utility curve cuts the x axis (total utility here is at its highest point). As we study further, we shall see that this theory of diminishing marginal utility underpins the idea of a downward-sloping demand curve.

maximising producers. We call this rational choice theory. Consumers consume a product until the marginal utility of the last unit consumed equals zero – on a graph, the marginal utility curve cuts the x axis (total utility here is at its highest point). As we study further, we shall see that this theory of diminishing marginal utility underpins the idea of a downward-sloping demand curve.

Adam Smith, the first economist (1776), noticed a famous paradox or contradiction – the paradox of value. Some products are widely available and are heavily consumed. This means that the marginal (extra) utility from consuming one more unit is low as is the price we are willing to pay for that unit. Even though the product may be vitally important such as bread in the UK the fact it is widely available reduces the value of an additional unit. Other products, such as Ferraris, are not widely available and have limited consumption. This means the marginal utility of an extra unit is high and therefore we are willing to pay a high price for it. Even though bread is more important in terms of our survival and provides more total utility we are not willing to pay as much for it as Ferraris because of its low marginal utility.

And producers may not always profit-maximise – alternative theories exist of managerial motives and also satisficing behaviour. In 1963 Cyert and March proposed that real firms aim at satisficing rather than maximizing their results. I.e., some groups may settle for “good enough” achievements rather than striving for the best possible outcome. This came from a concept known as bounded rationality, which was developed by Herbert Simon. Bounded rationality means prudent behaviour under a given set of circumstances.

In this model goals are not set to maximise profits,sales or even market share. Instead, goals are compromises negotiated by the groups. In an age dominated by concerns about climate change, it is possible that companies (for example Body Shop) source and price according to ethical concerns rather than pure profit. And consumers may be concerned about the ethical price and the ethical source, not the market price or lowest price.

Definition of ‘Rational Choice Theory’

Individuals always make prudent and logical decisions that provide them with the greatest benefit or satisfaction and that are in their highest self-interest – alluded to in Adam Smith’s explanation of self-interest and the invisible hand. Most mainstream economic assumptions and theories are based on rational choice theory.

Breaking down of ‘Rational Choice Theory’

Dissenters have pointed out that individuals do not always make rational, utility-maximizing decisions:

– The field of behavioural economics is based on the idea that individuals often make irrational decisions and explores why they do so.

– Nobel laureate Herbert Simon proposed the theory of bounded rationality, which says that people are not always able to obtain all the information they would need to make the best possible decision.

-Economist Richard Thaler’s idea of mental accounting shows how people behave irrationally by placing greater value on some dollars than others even though all dollars have the same value. They might drive to another shop to save £10 on a £20 purchase, but they would not drive to another store to save £10 on a £1,000 purchase.

Read more: Rational Choice Theory Definition | Investopedia http://www.investopedia.com/terms/r/rational-choice-theory.asp#ixzz3mNG2jpgn

0 Comments