Applied Issue: How OPEC Determines Oil Prices

5th September 2015

How OPEC determines oil prices

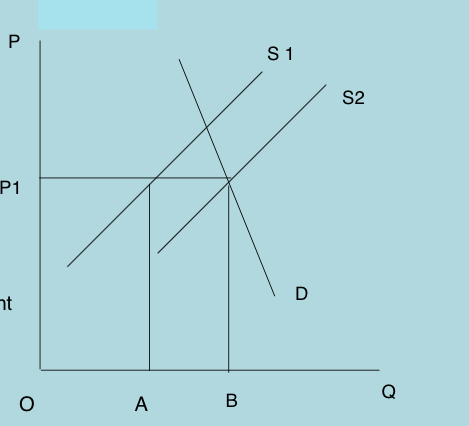

OPEC is a type of informal cartel which relies upon one major producer, Saudi Arabia, to alter production to maintain a price. In the diagram below, the agreed cartel price is P1,and S1 is the supply curve of OPEC countries excluding Saudi Arabia. Saudi Arabia controls about 30% of total OPEC annual production of oil. It is also the most powerful with huge cash reserves.

Saudi Arabia, in order to maintain price at P1 must supply AB of oil. S2 is total OPEC supply.

If the remaining eleven OPEC countries increase production (and, as happened from August 2014, break any agreed production quota), the supply curve S1 will move to the right. Now Saudi Arabia will need to cut its production below OA. In other words, it takes the loss in revenue caused by the ill-discipline of other OPEC countries. Moreover, Saudi Arabia is the least cost producer at around $3 a barrel and may begin to ask itself why it should effectively subsidise higher cost producers like Venezuela. Add to this that some OPEC countries are its enemy (such as Shiite Iran) and it is clear that Saudi Arabia may choose to abandon its role as market regulator.

Two further recent trends have increased the instability of OPEC. America, a major non OPEC producer, has increased production by 70% since 2008, with the discovery of shale-based oil and gas, becoming self-sufficient in oil for the first time in many years. And at the same time, demand for oil is actually falling due to changing consumer consumption patterns. The world, it seems, is becoming more and more energy efficient (and our cars do many more miles to the gallon). So the world demand curve for oil is shifting inwards to the left, providing more downward pressure on prices.

Market economics can predict what will happen next. Least productive wells, those extracting at a higher cost than price, will go out of business. American shale oil is particularly expensive at $60 a barrel. As America cuts domestic supply, its demand for OPEC oil will rise again. And as the world economic activity recovers, world oil demand will increase generally. The demand curve will eventually shift outwards and the supply curve will inwards due to contraction in supply due to the closure of uneconomic wells.

0 Comments