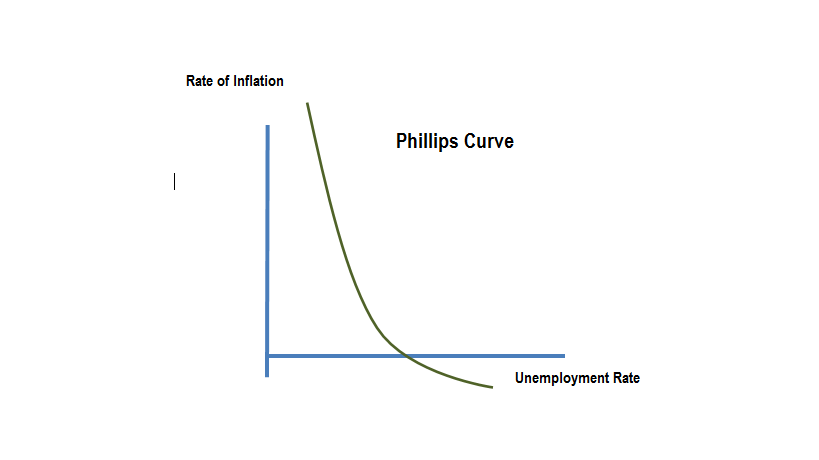

The Phillips Curve is named after A W Phillips. Phillips studied data on changes in money income and levels of unemployment during the period 1851 and 1957. His study revealed that as unemployment rose, the rate at which wages increased and as a result the rate of price rises (inflation). As unemployment increases workers are likely to be in a less powerful bargaining session when negotiating pay rises and this is likely to reduce pressures on inflation. Phillips findings have important implications for government. Phillips findings highlighted the opportunity cost of a low inflation policy. If the government adopts a policy aimed at controlling the rate of inflation it is likely to make achieving full employment difficult to achieve. The same problem exists if the government attempts to full employment, it is likely to lead to inflationary pressure.

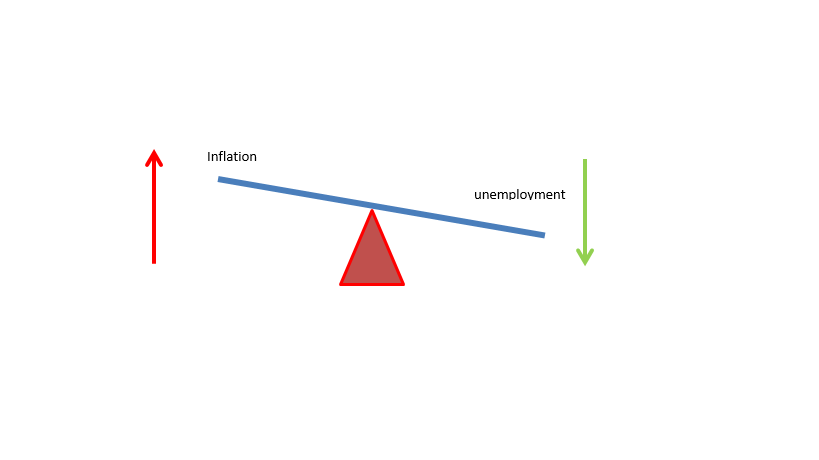

The situation is rather like sitting on a seesaw. If you push down on one side the other side will rise. Controlling inflation is likely to reduce aggregate demand and lead to higher unemployment levels.

If you implement measures to reduce unemployment then inflationary pressures are likely to build up in the economy.

If you implement measures to reduce unemployment then inflationary pressures are likely to build up in the economy.