Economies of Scale

26th April 2016

Economies of Scale

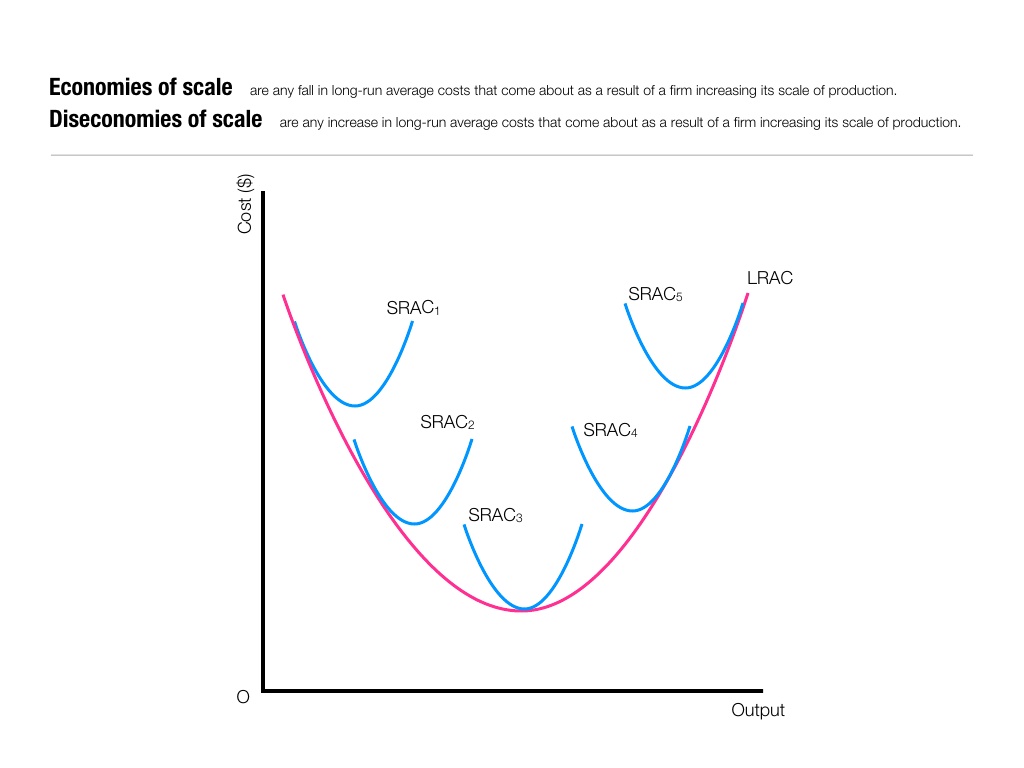

Economies of scale are the factors that cause average costs to be lower when operating on a larger scale than they would be on a lower scale. For example, doubling the output could lead to costs increasing by a lower percentage. This would mean that the cost of producing each unit would fall because factors of production would be used more efficiently.

Economies of scale are the factors that cause average costs to be lower when operating on a larger scale than they would be on a lower scale. For example, doubling the output could lead to costs increasing by a lower percentage. This would mean that the cost of producing each unit would fall because factors of production would be used more efficiently.

Economies of scale can be divided into internal economies of scale and external economies of scale. Alfred Marshall made a distinction between internal and external economies of scale. When a company reduces costs and increases production, internal economies of scale have been achieved.

External economies of scale occur outside of a firm, within an industry.

Internal Economies of scale

Technical economies – these may arise due to the use of machinery and equipment which may be used as an alternative to labour. Technical economies of scale may be achieved when the fixed costs of production may be spread over a large number of units of output. Firms may choose to merge in order to spread overhead cost. This is one of the arguments often put forward in favour of firms merging. Merged firms do not need two head offices, two finance departments or two personnel departments.

Purchasing economies of scale – may be achieved by bulk buying. Firms may by buying supplies of materials and parts in large quantities at a lower unit cost resulting in lower unit costs.

Specialisation – firms with a large workforce may be able to divide the work process into distinct tasks and the recruit people with specific skills to do these tasks. Staff can be trained to become more proficient at their designated tasks leading to an increase in productivity.

Marketing economies of scale arise because advertising on TV or in the press cost the same regardless of the number of units sold. Firms with high levels of output are able to spread the cost of advertising over a larger quantity of output and advertising cost per unit is reduced.

Risk Bearing economies – Research and Development and other large scale investments can be very expensive and be very risky. Only very large firms may be able to afford and be willing to undertake the necessary investment. Pharmaceutical companies have to spend million on developing new drugs. Many may never make it to market because of unforeseen side effects. The risk associated with drug development can be very high.

Financial economies – arise from the lower cost of capital for large firms. Large firms are able to borrow more cheaply than smaller firms. Equity investors may also be prepared to accept lower dividend yields from bigger firms because they are seen as a safer investment.

External Economies of Scale

External economies of scale are the benefits of scale that relate to the entire industry. If for example an industry is concentrated in one area it is likely that a pool of skilled labour will be attracted to the area. The cost of training will be reduced and local colleges may be prepared to organise training cost for workers. A concentration of firms may also attract suppliers to the area. Suppliers may be able to exploit economies of scale and this will lead to lower costs and lower process for customers. A concentration of firms may also lead to collaboration amongst firms in the industry on Research and Development.

[/vc_column_text][/vc_column]

0 Comments