Current Account Deficit and Foreign Investment (Nov 2015)

9th November 2015

source Deloitte’s Monday briefing November 9th 2015

A subtle analysis of our current account deficit reveals that it is a barometer of national savings. It is a lack of domestic savings which causes us to require large capital inflows to finance our appetite for imports. Here is an edited extract from Ian Stewart of Deloitte’s, plus some questions for class discussion.

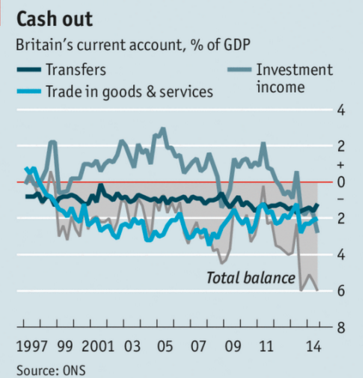

The UK current account deficit is widening: this represents a blow to the idea of a rebalanced UK economy, driven by exports and investment. The UK current account deficit, currently at 5.1% of GDP, is even larger than in the post war years which witnessed sterling crises: 1947, 1966, 1967 and 1976.

Note the dark grey line, investment income (net) has collapsed as a % of GDP, representing lower returns on overseas investment and increased payments overseas as returns for their capital.

This rise has been caused by a collapse in the UK’s surplus on investment income. In the past it was a surge in imports, and a widening trade deficit, which caused the deterioration. But since 2012 the UK’s trade deficit has been broadly constant, with a growing surplus on trade in services offsetting a widening deficit on trade in goods.

This time it is earnings on foreign investment, such as dividend payments and rents, which have caused the problem. In 2011, the UK earned £54 billion more on foreign assets than it paid out in income on UK assets owned by overseas investors. In 2014, that surplus had dwindled to just £2 billion.

Part of the shrinkage has been caused by a decline in income from the UK’s sizeable investment in overseas commodities businesses.But there is a more significant, longer term force at work too. The flip side of the UK running current account deficits over many years is that has imported capital from overseas. In the trade accounts the current account and capital accounts are exactly equal – in this sense the balance of payments always balances. Put another way, the current account deficit is a measure of national saving. If domestic savings don;t cover domestic investment, then we have to import our capital: we use the savings oft eh overseas sector. China, for example, has a huge surplus of domestic savings which it recycles by buying US bonds (amongst other things).

A deficit on the current account is funded by foreign capital inflows of the same amount. This capital is either deposited in banks or used to purchase assets, principally equities, businesses, real estate and government bonds.Today the UK’s current account deficit is being funded by selling UK assets to foreigners and by British investors selling foreign assets and bringing the money home. So the UK’s net stock of foreign assets – the difference between what the UK owns overseas and what foreigners own in the UK – has shrunk over time.

Bank of England data show that for much of the nineteenth century and up until the 1920s the UK ran a current account surplus and continuously expanded its ownership of foreign assets. The UK was a rentier economy, benefiting from the developments of other nations by providing them with capital and, in return, receiving income.

But since the Second World War the UK’s current account position has weakened and, for each of the last 30 years, the UK has run a current account deficit. The result has been a shrinkage of the UK’s net stock of overseas assets.Today the large net asset holdings of much of the last 150 years have disappeared. Indeed, the value of assets held by foreign owners is £450 billion greater than the value of assets held overseas by British companies and investors, equivalent to about 25% of UK GDP. The effects can be seen in the extensive foreign ownership of UK businesses, equities and government bonds.

The effects of foreign ownership of domestic assets is much-debated. Some see it as representing an unwelcome loss of control of national assets and akin to selling the family silver. But foreign ownership brings considerable benefits too, particularly through increasing competition and importing new ideas and processes. The British car industry is a shining example. It has gone from losses-making decline under UK ownership in the 1970s to profitable expansion under foreign ownership in the last 20 years.

The long term challenge posed by the decline of the UK’s net stock of overseas assets is that it means a shrinkage of investment income. UK investments consistently return 5% pa for foreigners, but the return on overseas investments have shrunk from 8.1% in 2011 to 5.9% in 2014. In the absence of an improvement in Britain’s export performance that points to continued current account deficits – and a further decline in the UK’s net stock of overseas assets. The risk is that at some stage overseas investors no longer want to buy any more UK assets. Foreign capital flight could lead to a collapsing exchange rate, a loss of confidence in the economy and soaring inflation.

So for a deficit nation investor confidence is vital. Despite having run current account deficits for 30 years, the UK, US and Australia, continue to prove attractive as destinations for foreign capital. Having a flexible economy and a flexible exchange rate also help – it gives a deficit economy a greater chance of eventually increasing exports and closing a current account deficit.

The UK’s current account deficit is, by historic and international standards, large. But as long as the UK retains the reputation as being an attractive place to invest and own assets it looks sustainable.

Further Britain’s Other Deficit Economist Oct17th 2015

Questions

- Explain the increasing current account deficit.

- Why is the deficit a barometer of national savings?

- “The balance of payments always balances”. Explain.

- Under what circumstances might the current account deficit matter?

0 Comments