Handout: National Income Accounting

15th September 2015

National Income Accounting

National Income is the monetary value of all goods and services becoming available to the citizens of an economy during a year as a result of economic activity.

How do we know if people are getting richer? Exactly how rich are we as individuals in comparison to other people in society. In terms of international rankings how far up the international league table is the UK?

To answer these questions economist need to gather information.

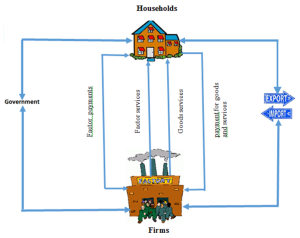

Economists try to make sense of economic information by constructing simple models of the economy, which aim to show relationships between the various parts of the economy. A study of national income involves constructing one such model – the circular flow of income model. National Income accounting assigns monetary values to variables within that model.

Factor services – land, labour, capital, enterprise

Factor payments – rent, wages, profit, interest

National Income can be calculated by using figures collated for:

- Total Income in the economy

- Total output in the economy, and

- Total expenditure in the economy

The figure for each of these measures, should in theory be the same and should enable the calculation of Gross Domestic Product at factor cost.

Income can be sub-divided into several parts.

- Income is generated from:

- labour services

- Income from employment

- Income from self-employment

- Firms generate Income from the capital they employ

- This income is known as profits in the private sector or,

- Trading surpluses in the public sector

- Rent is received by land and property owners

Two points should be made: –

Some incomes should not be included in National Income calculations.

- These incomes are called transfer payments

- Firms hold stocks of goods either ready to sell or, to be used in their own production process.

As a result of inflation these stocks may go up in value – this increase in revenue will boost profits.

However, stock appreciation needs to be subtracted from total income in order to produce an accurate National Income figure.

Calculating Expenditure

- Expenditure can be divided into:

- Consumer expenditure

- Government expenditure and investment

- Investment into new plant and machinery (fixed capital formation)

- Firms may also buy stock from other firms, or they buy their own goods to put into stock. The expenditure is known as the ‘value of physical increase in stock and work in progress.’

- Expenditure on exports by foreigners must be included in total final expenditure

N.B.

Not all expenditure is on domestic produced goods and services – the total value of imports must be deducted to provide and accurate figure for expenditure.

Goods which are subject to taxes and subsidies (i.e. VAT) should have the tax deducted, in order to arrive at an accurate figure for expenditure.

Calculating Output

National product can be calculated in two ways:

- Add-up the value added at each stage of production

E.g. Spaghetti Bolognese ready meals

| £0.60 Minced beef | |

| Manufacturer purchases materials | £0.10 tomato puree |

| £0.30 pasta | |

| £0.10 packaging | |

| Total: £1.10 |

Spaghetti Bolognese ready meal sold to supermarket for £1.50

Supermarket sell to customers at £1.99 each

The added value at each stage of the process is as follows:

The manufacturers suppliers added value is £0.60 + £0.10 + £0.30 + £0.10 = £1.10

The manufacturers added value is £1.50 – £1.10 = £0.40

The supermarkets added value is £1.99 – £1.50 = £0.49

If this process is carried out for all goods and services, then it should be possible to calculate the total value of all output.

*when calculating added value two conditions/qualifications need to be borne in mind.

- Part of the value of output will be imported (e.g. plum tomatoes). The value of imports must be subtracted from total output.

- Any increase in value of stocks must be deducted.

In order to obtain a more complete picture of National Income, other factors need to be taken into account.

- Net Property Income from abroad (NPIA)

- Foreigners on assets in the UK e.g. office blocks and factories etc.

- These assets earn interest, profit or, dividends. These earnings flow out of the UK and cannot be included as part of UK National Income

- At the same time as money is flowing out of the UK. UK individuals and business are investing money abroad. Returns from these investments flows back into the UK and can be added to UK national income figures.

National Income Statistics

In reality, National Income Statistics do not provide an accurate guide to the total level of incomes, output and expenditure.

A number of reasons exist for this:

- The basis of statistics is inaccurate.

- The government relies upon millions of individual returns from a variety of sources.

- Individuals may give inaccurate information or, may not return the forms (time consuming).

- Firms may not fill them in correctly – delegating task to an office junior

- Statistics are largely drawn from tax returns.

- People may wish to understate their earnings in order to avoid tax.

- Goods and services are subject to taxes or, subsidies. Both of these may distort the value of output.

- The main tax on goods and services is VAT (Value Added Tax).

- Excise duties are also levied on some goods such as alcohol.

- For some goods, the government will pay part of the cost of goods. Subsidies will understate the true economic cost of goods.

- All taxes and subsidies need to be excluded from calculations, since they do not correspond to any output.

Total Expenditure is (–)Taxes and,

(+) subsidies

The resultant figure is known as National Income at factor cost

The National expenditure figure is always higher than the National output or National income figure.

0 Comments