Handout: What is Money?

14th September 2015

Real and Monetary Sectors

It’s an Eternal Economic Truth that you cannot beat the market or beat back shifts in demand within a marketplace. This includes the market for funds, and when the consumers of savings (you and me) all turn up at once at a bank demanding our money back, the UK banking system is in serious trouble. It happened – in 2007.

The two major real-sector models of the economy are frequently contrasted: Classical theory and Keynesian theory. What we mean by real-sector is that our primary focus is on production (output, Q), consumption (C), and investment (I) – economic activities involving “real” economic goods, services, assets, and resources. This is not to say that money was absent in our analyses of the real sectors. Indeed, we were analysing markets for resources such as the labour market and markets for goods. In markets, real economic goods or resources are exchanged for money. But in our analyses so far, we have assumed that money itself was just another good like food.

The major utility (usefulness) of money, we have assumed, is its ability to be exchanged for anything else that we want to acquire. This utility or function, by the way, is called “medium of exchange”. This point of view, the idea that money is just another good albeit one with advantage being universally exchangeable, seems intuitively correct. After all, money is a “good” in the microeconomic sense – we would all like to have more of it and it seems like a scarce thing to us individually. And it has a market ‘price’ – the rate of interest.

But we aren’t studying microeconomics. We’re looking at the big picture, macroeconomics. That means we have to take a  much closer look at this thing called “money”. Purely real sector theories, as we’ve been studying so far, pretty much assume that the quantity of money in an economy is constant, or at least controlled from outside the economy. The formal term for this assumption is that “money is exogenous” – that is money has its origin or source from outside the workings of the economy itself. This might have appeared to be a reasonable assumption 90 years ago when most nations’ money was backed by holdings of a physical commodity: either gold or silver. A country with more gold could create more money. A country without gold couldn’t. But it really wasn’t and isn’t a good assumption. Money is only partly exogenous. The creation of money is endogenous to the economy, meaning activities by firms and households determine how much money exists subject to limits and creation of “base money” by government. In the middle of all this money creation is a peculiar institution called “banking”.

much closer look at this thing called “money”. Purely real sector theories, as we’ve been studying so far, pretty much assume that the quantity of money in an economy is constant, or at least controlled from outside the economy. The formal term for this assumption is that “money is exogenous” – that is money has its origin or source from outside the workings of the economy itself. This might have appeared to be a reasonable assumption 90 years ago when most nations’ money was backed by holdings of a physical commodity: either gold or silver. A country with more gold could create more money. A country without gold couldn’t. But it really wasn’t and isn’t a good assumption. Money is only partly exogenous. The creation of money is endogenous to the economy, meaning activities by firms and households determine how much money exists subject to limits and creation of “base money” by government. In the middle of all this money creation is a peculiar institution called “banking”.

Banks have been integral to market capitalism and industrialisation. While the story of the trade revolution (1600’s) and industrial revolution (1700’s-to present) have received the most attention in history books, these revolutions went hand-in-hand with the invention and evolution of banking. Today we live in a world of “fiat money” dominated by “fractional-reserve banking”. We have fiat money, which means what we think is money (dollars in the US, euros in Europe, etc), only has value because some government says it has value and will accept it as payment for taxes. There is no gold backing it up. There is no gold or other commodity backing the money.

Thinking about money, banking, and credit, particularly at the macroeconomic level, is not easy. It’s also often somewhat uncomfortable for people. We grow up since we were little kids just knowing that money is a valuable asset or commodity. It’s a convenient good thing that we carry around and exchange for other things. It’s’ “real” we think. Think again. It’s not “real” in the economic sense and it’s not natural. Money is purely a social invention. Money isn’t really a valuable commodity. Instead, money is just credit. It’s a promise to deliver real economic value sometime in the future. That’s it. It’s just promises. One suggestion: think about how money is treated in science-fiction movies like Star Wars. In those movies, people buy things by exchanging digital “credits”.

Also, we grow up thinking banks are safe places that store our valuable money for us. They don’t. Banks actually create the money they lend to us, and they lend out the money we deposit with them, all in an effort to make profits for themselves. Their ability to do this depends on the confidence we have in the banks. Banking is quite definitely, as you will see, a “confidence game”.

If, at some point in thinking about money and banking, you don’t feel like you’ve fallen down the rabbit hole like Alice in Wonderland, then you’re probably not thinking about it clearly enough. Even some of the greatest monetary economists have said that same. I will help you through this, but I’m just warning that a lot of long-held assumptions about what money is might be disturbed.

Money changes everything it is said. That is certainly true in macroeconomics. So with this unit, we begin Part III, our study of money, banking, and the economy. In this unit, then, our objective is to:

- Define money, describe the banking system, and explain the process by which the banking system creates and puts money into circulation subject to the creation of a “base money” by the government.

What is Money?

Money is obviously an important part of economics. In fact, many people mistakenly think economics is just the study of money — of course, by this point in the course you know that’s not true. Economics is about how people, individually and as a society, cope with scarcity by producing, exchanging, and consuming. Nonetheless, money does play an important role in economics, particularly in macro-economics.

But before we can examine the role money plays in the economy, we need to define money first. In other words, we need  to answer the question: What is money? In this section we focus on what constitutes money. You may think the answer is obvious: money is that stuff in your pocket that you use to buy things (granted some of you might suggest that money is exactly what you don’t have in your pocket and that’s why you’re broke). It’s also known as currency, cash, moolah, chickenfeed, scratch, dead presidents, etc. Well, you’re right. But is the paper currency and coins in your pocket all there is to money? Think about it a little deeper. Why are the paper dollar bills or pounds in your pocket considered money, but the piece of paper in my pocket with a grocery shopping list scratched on it isn’t considered money? They’re both paper. Why is a quarter “money”, but a prize token from Chucky Cheese isn’t? They’re both shiny tokens of metal. What is it about money that makes it, well, money?

to answer the question: What is money? In this section we focus on what constitutes money. You may think the answer is obvious: money is that stuff in your pocket that you use to buy things (granted some of you might suggest that money is exactly what you don’t have in your pocket and that’s why you’re broke). It’s also known as currency, cash, moolah, chickenfeed, scratch, dead presidents, etc. Well, you’re right. But is the paper currency and coins in your pocket all there is to money? Think about it a little deeper. Why are the paper dollar bills or pounds in your pocket considered money, but the piece of paper in my pocket with a grocery shopping list scratched on it isn’t considered money? They’re both paper. Why is a quarter “money”, but a prize token from Chucky Cheese isn’t? They’re both shiny tokens of metal. What is it about money that makes it, well, money?

Simply put, money is a token of purchasing power. In the absence of money, people have to trade with each other by exchanging goods, a process called barter. An example of barter is two kids sitting in school lunch room and each deciding the other’s lunch looks more appetising. They negotiate an exchange: “I’ll give you my ham & cheese sandwich in exchange for your cheese, crisps and biscuits.” The problem with barter is that it breaks down when when the number of goods and people gets large. It’s dependent on finding two traders who each want what the other has (a condition called double coincidence of wants). Large-scale barter simply isn’t feasible.

An even greater problem with barter involves time. In a barter exchange, not only do we need to have a double-coincidence of wants (you must need what I have, and I must need what you have), we need to have a coincidence in time. We must both want to make the same exchange at the same time. But that isn’t desirable. Let’s take an example. Suppose you are going to exchange your labour for food to eat. Let’s further suppose your employer, let’s call him pointy-haired boss, actually has food and wishes to use your labour. Under a barter system, you work only when you’re hungry. But pointy-haired boss might need you to work all day on some days and not at all on other days. Do you just starve on the other days? You might say, well the pointy-haired boss could give me a promise that he will feed me on my days off if I work all day today. Ok, but do you trust the pointy-haired boss? Besides, if he gives you a promise to feed you next Saturday, what do you if he reneges? So you say, “well let’s write the promise on paper and make it a legally enforceable contract where he owes me so much valuable food”. This is better, but you’re still dependent on the boss living up to the contract. What if the pointy-haired boss gets hit by a truck on Friday and can’t deliver on his promise? It would be better if the paper promise of future value was usable somewhere else besides the pointy-haired boss. If it was, we would have “money”: little promises (credits) of economic value that can be redeemed in the future for real things.

So, there we have it. Societies have invented “money”. Money is credit. It’s promises to deliver real economic value that are universally redeemable within that society/nation. Typically money is measured or denominated in little somewhat standardised units of value. In the U.S. the unit of money is a “U.S. dollar”. In Japan, it’s a “yen”. In the U.K. it’s called “a pound sterling”.

Of course, it’s inconvenient to always write a full contract that states the value being promised. If part of a contract was redeemed, such as in our example, you worked all day but only wanted to redeem that portion that would give you a Coca-cola right now, you’d have to rewrite the whole contract. It would be more convenient if society had some sort of official tokens to use instead of always writing out a debt contract. Fortunately for us, societies as old as the ancient Mesopotamians have been searching and exploring for what to use as these tokens. Today, the tokens we use are called paper currency and coins. But we also use custom written paper contracts, too. They’re called “checks”. Nowadays, we even use a purely digital form of keeping track of our “credits” or money in bank accounts electronically.

redeemed, such as in our example, you worked all day but only wanted to redeem that portion that would give you a Coca-cola right now, you’d have to rewrite the whole contract. It would be more convenient if society had some sort of official tokens to use instead of always writing out a debt contract. Fortunately for us, societies as old as the ancient Mesopotamians have been searching and exploring for what to use as these tokens. Today, the tokens we use are called paper currency and coins. But we also use custom written paper contracts, too. They’re called “checks”. Nowadays, we even use a purely digital form of keeping track of our “credits” or money in bank accounts electronically.

In our modern society, the use of money has evolved significantly. With modern technology, we no longer need to use some actual, physical commodity as the token of purchasing power. Instead, we now carry pieces of paper that are themselves tokens of the purchasing power we possess. We can use these pieces of paper to buy and sell. Computer and network advances of the last 40 years have taken us to to the point where we don’t need any physical tokens at all. Instead a record of our purchasing power is kept simply as a number on a computer at some bank. When we buy something, we simply tell the bank to reduce the number that represents our purchasing power (your bank balance) and to increase the seller’s record of purchasing power (the seller’s bank balance). It’s still useful, though, to think of those numbers at the bank as representing some amount of actual money tokens.

History of Money

Money is what economists call a “social contrivance” – a practice or institution that society has defined and created and isn’t naturally occurring. Since societies have evolved throughout history, so has money and the tokens used. Like many concepts in macroeconomics, there are two different stories of how money came to be in society.

One commonly offered explanation of the history of money emphasises money’s role in overcoming the double-coincidence of wants problem of barter. This story emphasises money’s role as purely a medium of exchange and traces the evolution of society from using highly-valued commodities (such as livestock) in economic exchanges to using jewels and precious metals to using gold/silver coins to eventually using paper money and digital credits. A very humorous, light-hearted take on this story is available in this Youtube video:

This version of the history of money (the private evolution of livestock-to-precious metals-to-gold-to-paper, not the video), has been relatively popular among economists, particularly Classical-oriented economists, for a long time. It’s origins come from some speculation by Adam Smith that societies at one time were barter-based and searched for a better way. The story is popular because it suggests there’s little room or need for government in the history of money. In fact, government is often cast as a “bad guy” for having debased money by diluting the gold content of coins.

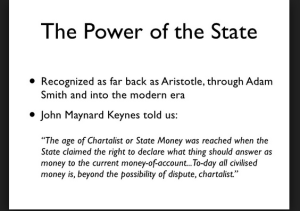

Unfortunately, the story hasn’t held up well in the light of historical, anthropological, and archaeological evidence, (never underestimate the ability of some theoretical economists to ignore factual evidence!). The historical and archaeological evidence suggest a different story for the history of money, a story called the “chartalist” view. What we find historically is that money only exists where and when a strong or credible government exists. And, we find that markets and a widespread market economy typically only exist where a stable money exists created by government.

In the chartalist story of the history of money, money is created when a government or ruler finds itself in need to  purchasing or obtaining real goods and services. For example, an early ruler needs food and weapons to feed and equip soldiers. The government or ruler, having nothing to trade for these goods creates or defines some token and calls it money. The token has no inherent economic value on it’s own. The sovereign, the ruler, offers to pay for goods by paying with the tokens. Obviously, it’s not much of a deal for the farmers or blacksmiths. What are they going to do with these useless tokens? To provide and define value for the tokens, the sovereign levies a tax on the people and declares that the tax can only be paid using tokens. But how do the people get the tokens to pay the tax? The farmers and smiths are now willing to sell real goods to the sovereign ruler in return for the tokens since other citizens are willing to sell real goods to the farmers and smiths so the citizens can get their hands on tokens so they can pay taxes. The tokens now have an accepted economic value and begin circulating as money and as a medium of exchange. As long as there is confidence that the sovereign will continue to rule, people are even willing to accumulate and a store of tokens for future spending (savings). If enough money begins to circulate and gets accumulated, then wealthy people can create banks and make loans of money using paper certificates that promise they can be converted into tokens.

purchasing or obtaining real goods and services. For example, an early ruler needs food and weapons to feed and equip soldiers. The government or ruler, having nothing to trade for these goods creates or defines some token and calls it money. The token has no inherent economic value on it’s own. The sovereign, the ruler, offers to pay for goods by paying with the tokens. Obviously, it’s not much of a deal for the farmers or blacksmiths. What are they going to do with these useless tokens? To provide and define value for the tokens, the sovereign levies a tax on the people and declares that the tax can only be paid using tokens. But how do the people get the tokens to pay the tax? The farmers and smiths are now willing to sell real goods to the sovereign ruler in return for the tokens since other citizens are willing to sell real goods to the farmers and smiths so the citizens can get their hands on tokens so they can pay taxes. The tokens now have an accepted economic value and begin circulating as money and as a medium of exchange. As long as there is confidence that the sovereign will continue to rule, people are even willing to accumulate and a store of tokens for future spending (savings). If enough money begins to circulate and gets accumulated, then wealthy people can create banks and make loans of money using paper certificates that promise they can be converted into tokens.

This chartalist account of the history and evolution fits well with historical and archaeological evidence. The most common tokens of money issued by governments throughout history have been coins based on some kind of precious metal alloy. But contrary to some myths, coins have never contained enough precious metal to define their value. In other words, there’s never been enough gold in a gold coin to justify it’s circulating face value. Even gold coins have only ever been tokens, not actual bits of the commodity. At times governments have used tokens other than metal-alloy coins as their tokens of money. Obviously, today we use pieces of paper with pictures of dead presidents on them as tokens. In ancient Mesopotamia, little pieces of fired clay were accepted as tokens and money. For a long time throughout the middle ages and even later, wooden sticks with distinctive marks, called “tally sticks”, were accepted in England as money and as payment for taxes.

A reminder of this history of money as a credit token to be used to pay taxes is engraved on our coins and paper dollars today. On the U.S. one dollar bill, just under the “THE UNITED…” part in the upper left, you’ll see this inscription: “This note is legal tender for all debts, public and private.” That’s what separates that one dollar bill in your hand from any other approximately 2 1/2′ x 6″ piece of paper.

The Functions of Money: Money Is Useful

While it’s obvious that money is useful, it actually has multiple functions, or roles, in the economy. The first function is the most obvious: it’s a medium of exchange. It helps eliminate the problems with barter and allows people to buy and sell things easily.

But money is also useful as a store of value. Any asset that keeps it’s market value over time can be used to store your wealth. Let’s suppose you save up £15,000 that you want to keep for use in a few years from now to buy a house. Any asset that keeps it’s value could theoretically be used to store this purchasing power until you need it. But they aren’t all as convenient or safe as money. You could buy £15,000 worth of gold. Gold keeps well, but it’s difficult and costly to store. You could buy £15,000 worth of grain. But it’s inconvenient to store and it’s likely to spoil. But, if you keep your purchasing power in the form of money, then it’s easy to store, save, and use later.

Finally, the last function of money is so basic, that sometimes don’t see it. Money is how we measure purchasing power. It’s how we measure our income and our assets. This function is called money as a unit of account. Try telling somebody how large your income is without making use of some form of money to measure it. It’s pretty hard.

In many ways, this multi-functionality of money is responsible for making monetary economics very complex. Questions that at first might seem simple, like “how much of their assets do people want to own as money (as opposed to something physical) at any point in time?” become very complex to answer, yet it affects how society saves, consumes, and invests, which in turn affects growth and employment.

Money Leads to Banking

The history of money-lending is almost as old as the history of money, but we won’t go through all that here. Suffice to say that as long as there’s been money, there have been people with more money on hand than they need to use immediately and people who didn’t have enough money and needed it now. Those with the money saw an opportunity to profit by lending at interest to those that needed money now.

However, the history of banking is a bit shorter. It parallels the emergence of large-scale trading during the Renaissance. But banking really emerged as a major institution with the industrial revolution. It was during this period when modern “fractional reserve banking” began to evolve. Fractional reserve banking (what exists today) is business that makes profits by taking accepting deposits from people with money and lending it out at interest to other people who need to borrow. It is effectively, the art of making profits by taking risks with other people’s money.

Most of us grow up thinking a bank is a safe place to store our money, often times safer than keeping it all on our person or at home in a piggy bank. We don’t want the risk of loss due to theft or the temptation to spend when we shouldn’t, so we deposit it at the bank. But what happens then?

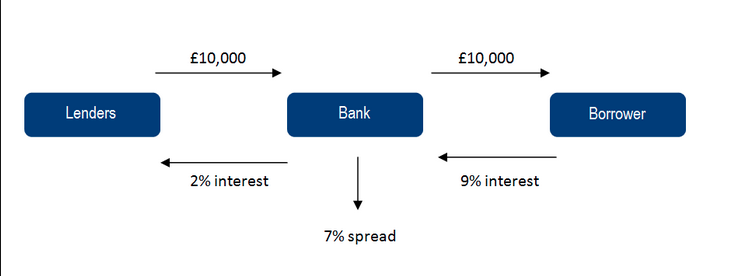

Banks don’t just keep your money sitting in the vault waiting for you to withdraw it. They loan out your deposit to borrowers. They charge the borrowers interest. Suppose you deposit £110. The bank then loans out, let’s say, £100 to somebody else, leaving only £10 in the vault and pays you a 2% savings rate. After a while the borrower pays back the £100 plus say £9 in interest after one year (9% interest rate). After the loan is paid back, the bank has £117 in vault. You come in and withdraw your £100. You have your money back and the bank is left with an £7 profit. The difference is called the spread – the difference between lending and savings rates.

The bank makes it’s profits by loaning out at interest the money that depositors have entrusted to it. This is such a profitable business that banks will often pay depositors to put money into the bank. This is the interest rate the depositor or saver gets paid. Of course, the interest rate the bank pays the depositor is never as large as the interest rate the bank charges the borrower. To make a profit, a bank must charge higher interest rates for loans than it pays for deposits. For example, a savings account at a bank might pay 3% interest. But the loans made by the bank using those savings deposits will be charged anywhere from 6% to 28% (or higher).

It sounds like an easy way to make profits – using other people’s money to make loans that you charge interest on. The  catch for banks is that they can’t predict when the depositor will want to withdraw the deposit. Go back to the example above. You’ve deposited £110. The bank loaned out £100, leaving £10 in the vault. Suppose you want to make a withdrawal of your own money before the borrower has paid the bank back. If you want to withdraw less than £10 of your £110, then everything’s fine. The bank takes it out of the vault. But what if you want to withdraw £50? The bank doesn’t have it. The bank only has £10 in the vault – the other £100 is off with the borrower somewhere. The bank can’t give you your money back. If everyone turns up at once (as with Northern Rock in 2007) the bank fails. Without an insurance scheme (which we have in the UK for deposits up to £85,000 per person) you’ve lost your money. For ever.

catch for banks is that they can’t predict when the depositor will want to withdraw the deposit. Go back to the example above. You’ve deposited £110. The bank loaned out £100, leaving £10 in the vault. Suppose you want to make a withdrawal of your own money before the borrower has paid the bank back. If you want to withdraw less than £10 of your £110, then everything’s fine. The bank takes it out of the vault. But what if you want to withdraw £50? The bank doesn’t have it. The bank only has £10 in the vault – the other £100 is off with the borrower somewhere. The bank can’t give you your money back. If everyone turns up at once (as with Northern Rock in 2007) the bank fails. Without an insurance scheme (which we have in the UK for deposits up to £85,000 per person) you’ve lost your money. For ever.

It should be obvious now that banking is a business that requires confidence. Depositors must have confidence that they will get their money back when they want it. The bank has to carefully balance the amount of loans it makes (more loans –> more profits!) with the risk of failure (more loans –> increased risk of failing). In many ways, banking can be considered a confidence game. If they lose the confidence of depositors, they fail. And historically, banks have failed. In 1930-32, over half of all banks in the U.S. failed. Depositors in those banks only recovered $0.89 out of every dollar they thought they had on deposit.

If everyone turns up at once and asks of their money back, the UK banking system would collapse overnight.

In fact, banks still often fail. Lehmann Brothers collapsed in 2007, and Northern Rock and other UK banks would have collapsed in 2007 if the Government hadn’t stepped in and nationalised them. Don’t panic and withdraw all your savings and put it under your mattress, though. The US and UK have evolved programmes that help protect the depositor when banks do fail. One of these programs is called the Federal Deposit Insurance Corp.(FDIC). The UK has a similar system: In 2015 the Prudential Regulation Authority in the UK raised the amount of deposits (savings) protected from £75,000 to £85,000 per person – read more about this scheme here.

Measuring Money: M1

Even though most “money” doesn’t physically exist in today’s economy since it’s only a number on an account at a bank, we can still count how much exists. Economists have ways of counting how much money exists at any point in time – it’s called M1 or M2. To understand what M1 is and how much “money” is in the economy, it’s useful to think of “money” as being immediately usable spending power. The difference between M1 and M2 is in how “liquid”, or how easily spent, the money is. M1 is the most liquid. It consists of physical currency in circulation among the public (outside banks), total traveler’s checks, and the total of all demand deposits at banks. Demand deposits are usually known as “checking accounts” among most people.

M1 is typically called the supply of money to the economy, or the money supply. Growth of the money supply is a critical variable in determining the health of an economy. Indeed, the growth of M1 can easily determine whether or not an economy suffers from inflation or deflation. So it’s important to know how money is added to the economy. In other words, we need to know how new money is created.

Creating Money from Nothing

In a modern economy that has fiat money (money that is not backed by gold or any other commodity) and fractional reserve banking, banks create money. They do this by the process of making new loans. Thus an economy that starts with a fixed amount of money at one point in time, can, through banking and the loan-making process, create additional money. The money supply can be expanded. Despite the fact that there is no gold or other commodity “backing” our modern money, there is a limit as to how fast banks can create new money. Banks are limited in their ability to create new money by the need to keep part of their deposits as reserves. Thus required reserves limits how fast banks can create new M1.

What’s Next: Where A Bank Does It’s Banking

When you and I need a safe place to keep our money, we deposit it in a bank. When we’re a bit short and we need some money, we borrow money from a bank. But what does a bank do when it needs a safe place to keep money? What does a bank do when it’s a bit short and needs to borrow? Banks do the same as you and I. Banks go to a bank. Sometimes they deal with other commercial banks. But often, banks do their banking at a special bank. These special banks are called Central Banks, and they have enormous power to influence the economy. We will study them in the next handout.

Jim Luke

Lansing College

0 Comments