Extract: Recent Trends in Sterling’s Effective Exchange Rate (with Questions)

7th September 2015

This is an extract from a longer speech by Kristin Forbes, Member of the Monetary Policy Committee, Bank of England At 100 Women in Hedge Funds, Canada Imperial Bank of Commerce, London Wednesday 1 October 2014

The impact of exchange rate movements is even greater for the more open United Kingdom. Traded goods and services constitute over 60% of the UK economy. Currency movements directly affect the competitiveness of exports and import-competing domestic firms, and therefore production, employment, and profitability in both of these sectors. About 80% of sales by companies in the FTSE 100 are earned overseas.

Currency movements directly affect how these international profits are translated back into sterling, and therefore stock market valuations and dividend payments – and thereby investors and

individuals with equity exposure through their pension funds. About 30% of the main price index is imported goods. Currency movements directly affect many prices and how far a family’s paycheck can go, thereby influencing the appropriate path for monetary policy in order for the Bank of England to reach its inflation target.

All workers, consumers, producers, and investors should appreciate the power of the exchange rate to influence multiple aspects of the economy and their daily lives.

Recent Trends

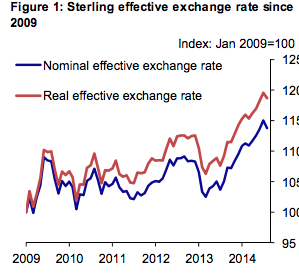

Figure 1 above shows the movements in the sterling effective exchange rate since its recent trough at the start of 2009. These indices weight movements in sterling relative to other countries’ currencies by the other countries’ share of UK trade. The blue line is the nominal exchange rate index and the red line is the real exchange rate index (which adjusts for inflation differentials between the UK and other countries). Although both measures of the exchange rate index have recently weakened slightly, these movements are overshadowed by the sharp nominal appreciation of 14.5% from March 2013 to July 2014.

Time-lags are important

The effects of exchange rate movements generally take a substantial amount of time to play out– and so it is the lagged impact of this appreciation which is affecting the economy today and which will continue to be the primary impact of sterling on the economy over the next few quarters.

Sterling has fluctuated within fairly narrow bands since 1990, punctuated by four large movements.

Sterling depreciated sharply when the UK left the ERM in 1992 (by 20%), and even more sharply during therecent financial crisis (by 27%). The pound appreciated quickly between mid-1996 and late 1997 (by 27%),and then most recently from March 2013 to July 2014. Even though the recent appreciation is substantial, it only partially offsets the much larger depreciation that occurred during the financial crisis. In fact, despite sterling’s recent strength, the exchange rate index is still below its averagevalue of 92 since 1990. This should not be used to evaluate if sterling is overvalued or undervalued – to make that assessment would require a full analysis of the“equilibrium” exchange rate – but simply to highlight that sterling does not appear to be substantially out-of-line with where it has traditionally been.

Effects on Exports and Profits

When a country’s currency strengthens, the effect that generally receives the most immediate attention is that on exports and profits. A stronger currency will – holding all else equal – make domestic producers less competitive relative to foreign producers. This can present challenges not only for exporting firms, but also for some domestic producers, as consumers can shift to imported substitutes that are now relatively cheaper.

Firms may choose to keep sterling prices constant, and thereby risk losing market share as their items will bemore expensive than foreign items. Or they can choose to lower prices in order to remain competitive, but thereby accept lower markups and profits.

A stronger pound reduces the value of foreign earnings when translated back into sterling using the current exchange rate. As a result, even if a firm listed on the FTSE produces and sells abroad, so that currency movements do not affect its relative costs, sales, or profits, these profits will be worth a smaller amount of sterling. Thiscan have real effects on an economy by affecting price/earnings ratios, stock prices, and dividend payments.

Capita Asset Services estimates that the effects of stronger sterling will cut the dividends paid out by UK companies by £4.4 billion this year – thereby affecting pensions, retail investors, and anyone who holds shares in these companies. Analysis by Goldman Sachs argues that the primary factor behind the FTSE’s underperformance relative to other major developed economies has been sterling’s strength.

Short run or Long run effects?

Changes in the real exchange rate do not initially have a significant effect on total exports. Over periods longer than one quarter, however, a stronger real exchange rate is correlated with a significant fall in total exports. Although the estimates should only be interpreted as a rough guide to the magnitude of this effect, they suggest it is meaningful; a 10% appreciation of sterling – holding all else equal – is predicted to cause a 3.1% fall in export volumes over the long term. The effect is estimated to be more important for goods exports than services.

http://www.bankofengland.co.uk/publications/Documents/speeches/2014/speech760.pdf

Questions:

- The speech was delivered a year ago. How has sterling performed since?

- Why are time-lags important when assessing the effects of an exchange rate moment on the real economy?

- Explain in your own words the implications on a. exports, and b. firms’ declared profits of sterling’s appreciation.

0 Comments