Applied Issue: The Phillips Curve in the UK (2014-15)

5th September 2015

The Phillips Curve

Source: EI Economic Review by Peter Baron

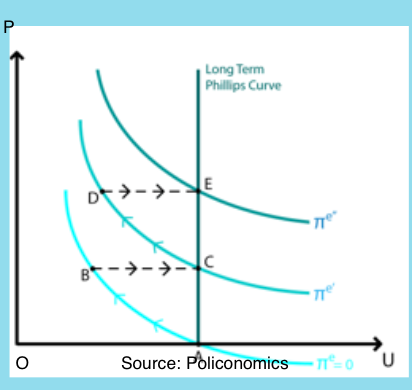

Professor Milton Friedman helped to explain the breakdown in the Phillips Curve trade off between unemployment and inflation in the 1970s.His theory of the expectations- augmented Phillips Curve posited that, as inflationary expectations take hold, workers begin to anticipate price rises in their wage bargaining. Strengthened by Trade Union power, any successful rise in wages in line with expected inflation itself increases the price level – a movement from A to B, as companies pass on the higher costs in higher prices.

Phillips Curve (Source: Policonomics)

However, the cost rise creates a new supply curve at a higher price and the same quantity that was enjoyed before. As the Phillips Curve moves outwards (reflecting a supply curve shift due to the rising costs) so the economy moves back to point C. Notice that this represents a higher price level, but unemployment that is unchanged on OA.

OA is the natural rate of unemployment. The natural rate is sometimes called the non- accelerating inflation rate of unemployment – a rather long-winded but accurate description. Attempts to move the economy below OA will always result, said Friedman, in rising inflation. This is because OA is given by structural features of the labour market.

What are these structural features? Well they are the very things George Osbourne has been seeking to address in successive Budgets. They include the relationship between benefits and wages at the low paid end of the market, the ability of labour to move to new jobs or to train in new skills. So the natural rate can be influenced by things as diverse as housing policy and regional house price differences, the level of benefits, the level of the minimum wage (currently £6.50 an hour for over 18s), and training programmes.

Friedman is making an important point: there is a limit to the usefulness of demand side policies if you don’t address the supply-side – indeed, demand management can be economically suicidal.

Interestingly, in 2014 the MPC had two targets, an inflation target of 2% and an unemployment target of 7%. This seemed to imply that they thought the natural rate of unemployment was 7% and that as unemployment fell below this they would raise interest rates to try to slow the growth in demand and output. Unemployment fell below this, of course, to 5.6%, and no interest rate rise occurred.

Maybe the UK economy has really become more flexible and the natural rate is some way below what the MPC believed. If so, it is a supply-side improvement worth noting.

0 Comments