Inflation and Unemployment 2014-15

5th September 2015

Inflation and unemployment

Source: EI Economic Review 2014-15 by Peter Baron

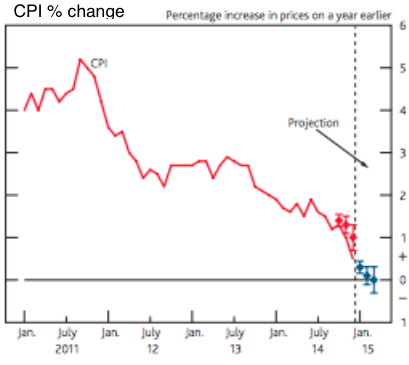

We have already noted that inflation has been much lower than forecast at 0.5% for 2014. Prices continue to fall, driven down by three factors:

- The halving of oil prices.

- The strengthening exchange rate.

- The fall in food prices.

Furthermore, there is a second round effect of the fall in oil prices. Oil represents 2.5% of total UK production costs. So as oil prices fall, there is a second round declining cost push effect on overall inflation rates.

CPI % change (BEQB)

Energy represents a weighting of 3.7% in the CPI. The Bank estimates that a 10% fall in oil

prices reduces domestic inflation by 0.15%. It follows that a 50% fall reduced UK prices by about 0.75%.

In 2015 it is likely that the UK will experience negative inflation (negative price rises) for the first time since 1960. Usually this would be seen as something serious, the consequence of a severe depression. However, deflation is an aggregate demand concept, meaning a downward multiplier effect on growth, whereas what the UK is experiencing is strong positive growth with negative inflation. The effect of ‘bad deflation’ is to make rational consumers postpone consumption as they expect prices to fall further, making the slump in output even deeper. One key effect of this is the influence on inflationary expectations.

Milton Friedman explained the breakdown of the simple Phillips curve tradeoff of a little more inflation for a little less unemployment in the 1970s and 1980s by the role expectations play in wage bargaining (see page 9). Put simply, as workers expect accelerating inflation they translate this into bargaining for higher wages, which itself, through its impact on company unit costs, gives a further cost-push boost to prices. So inflation expectations matter for monetary policy because they can play an important role in determining wage and price-setting. For example, employees may have less bargaining power or be less inclined to bargain for higher nominal wages if inflation expectations fall. Companies may also hold back price increases if they think competitors’ prices will be increasing less rapidly.

However, the negative inflation of 2015 can be seen as beneficial, because it allows the Bank to engage in further quantitative easing back to its target inflation rate of 2%. At the same time, real wages should recover strongly this year, giving a further boost to UK growth. We can see this unexpected bonus to growthasachancetorealignthesupplysideoftheeconomy,by encouragingfurtherbanklendingfor investment in capital goods and infrastructure. This should produce a second round boost to production, as the production possibility frontier moves outwards. As production increase it should be possible to maintain demand at non-inflationary levels, as aggregate demand and aggregate supply curves move outwards in unison.

0 Comments