Handout: Motives for Merger

4th September 2015

Motives for Merger

Market Structure

Is the market oligopolistic? By this we mean are there several main operators / providers in the market?

Examples:

- UK grocery market – Tesco, ASDA, Sainsbury and Morrisons,

- UK Mobile networks – O2, Vodafone, EE and 3.

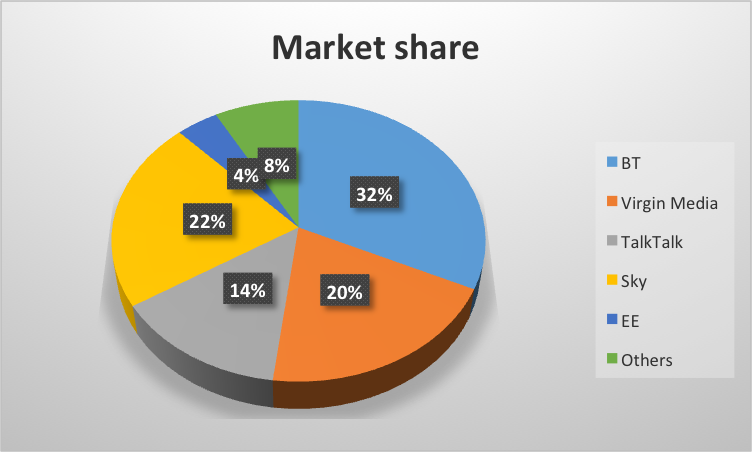

- UK Broadband internet market (see below)

Figures sourced from Ofcom

2. Eliminate competitors

Merging with, or taking over, a competitor represents an effective (but expensive) way of reducing the level of competition in the market.

Example:

British Airways responded to the emerging threat of budget airlines by creating its own cut-price airline with frills. The new company ‘GO’ did well. Some years later Easyjet bought ‘GO’ for £374m, removing a significant competitor and leaving Easyjet as the largest budget airline.

3. Relative Performance

How is the business performing when compared to their rivals? Remember performance can be judged by looking at various indicators including sales, profit, market share or rate of expansion.

Examples:

Cadbury became a target for Kraft because its profit performance was better than the sluggish growth achieved by Kraft. The takeover was intended to increase financial performance and appease shareholders.

Coca Cola is entering a mature phase of development for its core business. Acquiring Innocent drinks was a way of diversifying into natural drinks market and was part of a wider strategy to broaden its portfolio into water and juice-based drinks.

4. Growth Potential

If the opportunity for natural (organic) growth is limited then this is likely to prompt businesses to consider a merger or takeover. Common reasons for this include a competitive or saturated market.

Examples:

Source: VW

VW is an example of a company that has adopted a policy of acquisition in the mature car market. It strategy has allowed it to establish a presence in a segments which are less price sensitive and more profitable.

Whitbread acquired a little known coffee roasting company as regulation squeezed its core brewing business. The strategy led to the development of the UK’s biggest chain of coffee shops

5. Expertise Gaps

Here you need to consider if merging will help the organisation to extend the things they are good at or reach into new markets.

Examples:

Tata Steel is an Indian conglomerate. The acquisition of Land Rover and Jaguar gave Tata access to the design expertise of the UK car company and strengthened its development base for its Indian car business.

Cadbury were targeted by Kraft due to their presence in developing (growth) markets, something that Kraft found attractive given their reliance on the saturated US market.

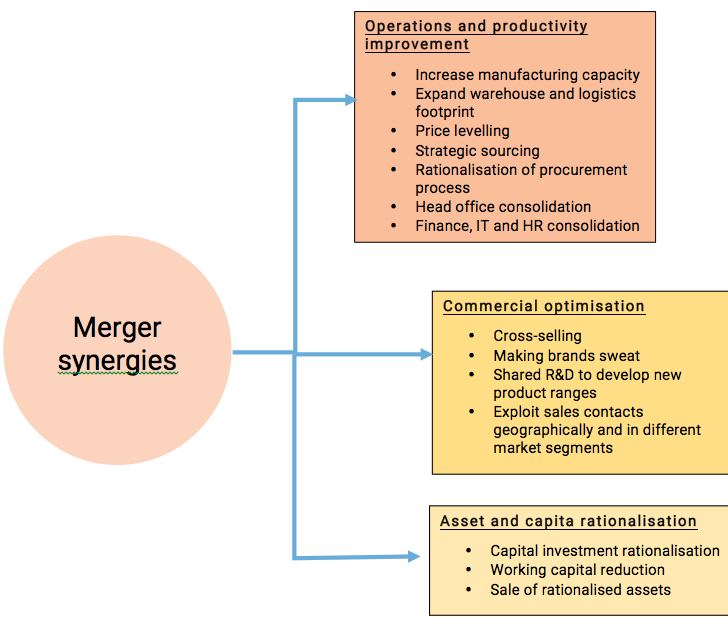

6. Synergies

Synergy simply means blending or combining for mutual benefit. There are various synergies aside from the obvious cost saving benefits from avoiding duplication and combining back office services.

Diageo is a merger of two drinks groups which enabled it to expand its global reach and increase its market concentration. Continuing acquisitions have helped Diageo to expand its global reach.

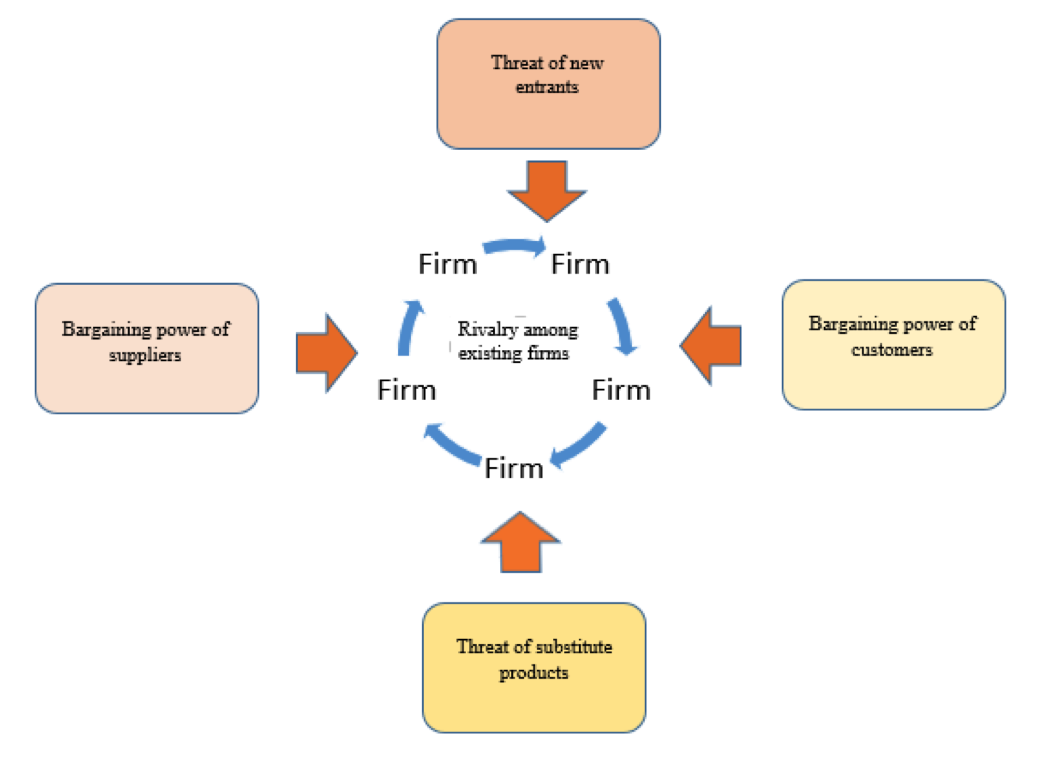

7. Reconfigure Porters 5 Forces

Consider whether or not the merger will favourably change the 5 competitive forces (according to Porter) for BA.

Examples:

The merger between BA and Iberia has transformed the group from a loss making business to a profitable airline. Continuing acquisitions have strengthened the company’s position. Initial projections were that the merger would save the new group IAG £350m a year and create a business with more than 62m passengers each year.

0 Comments