The Coffee Market

The world coffee market is worth $81 billion dollars. World coffee production for 2015/16 is forecast to rise by 600,000 bags due to record ouput in Indonesia and Honduras as well as recovery in Vietnam, These increases more than offset a fall in production in Brazil.

Coffee is more than just a drink, it is a global commodity. Coffee is one of the world’s most traded products, Coffee is second in value only to oil. The coffee industry employs millions. Coffee is vital to the politics, and economies of many developing nations.

International Coffee Agreements

Since 1963, the International Coffee Organization (ICO) has operated under a series of International Coffee Agreements. The agreements were negotiated under the authority of the United Nations.

The International Coffee Agreements had some success in ensuring stable coffee prices. The agreements involved both importing and exporting countries and helped to limite excess supplies using a quota system and price controls. At the same time coffee consumption rose. The early agreements helped strengthen the economies of coffee-producing countries in Africa and Latin America.

The support of the United States was instrumental in ensuring the success of the International Coffee Agreements. The US was instrumental in enforcing a quota system. The U.S. withdrew its support in 1989 and this had global consequences.

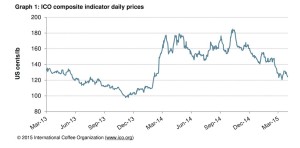

In 1989, the ICO suspended the quota system with disastrous consequences. Coffee prices fell by a half. The ICO Failed to gain agreement on price regulation and coffee prices plummeted.

Coffee Crisis

Coffee accounts for nearly half of the total net exports from tropical countries and is representative of the economic and agricultural issues that developing countries face today. By 2001, coffee prices had fallen to an all-time low. This fall in prices affected more than 25 million households in coffee-producing countries and undermined the economic sustainability of countries in Latin America, Asia and Africa.

The fall in coffee prices was due to a number of factors. The collapse of regulation, fluctuating markets, new market entrants and the exploitation of market power by roasters and retailers. Increasing production and only a modest growth ed to excess supply. Problems were further exacerbated by policies introduced by the World Trade Organization (WTO) and the International Monetary Fund (IMF).

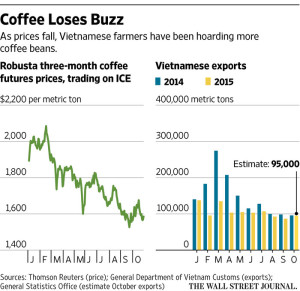

Between 2001 and 2002, world coffee production was estimated to be 11.6 million (60-kilogramme) bags, while consumption was only five million bags. Vietnam entered the coffee market, becoming a major coffee producer and exporter.During the 1990’s Vietnam increased its coffee production by 1,400 percent. Vietnam’s entry into the market producing low grade coffee hit many smaller coffee producers in other countries.

Economists suggest that controlling supply and fair trade initiatives could solve the coffee crisis. Fair trade measures guarantee farmers a fixed minimum price for their coffee. Fair trade prices can be as much as two or three times the unsubsidized market price. Fair trade eliminates the middlemen exporters who often pay farmers below market rates before reselling at rates set by the New York Coffee Exchange.

Coffee-producing countries also need to reduce their dependency on exports on coffee and diversify into alternative crops. Poor African countries such as Burundi, Uganda and Ethiopia are particularly dependent on coffee. They derive half their export earnings from coffee. Regulating coffee production could benefit small-scale family farmers(who produce 75 per cent of the world’s coffee supply) ensuring that they receive a living wage. The social and economic effects of falling coffee prices are profound.

Price Control and World Trade

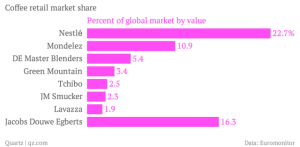

Coffee price declines can be devastating for farmers abroad, but in the United States, the world’s largest consumer of coffee, such fluctuations are barely noticed. The world coffee market is dominated by four multinational corporations: Kraft General Foods (owner of Maxwell House and other brands), Nestle, Proctor & Gamble (owner of Folgers and other brands) and Sara Lee (owner of Chock Full O’Nuts and Hills Brothers).

In an unregulated market, such large corporations were able to control the price of coffee-as they purchased more products, prices skyrocketed. Today, large-scale coffee importers and roasters purchase coffee futures and options in order to protect their stocks’ worth through the Coffee, Sugar and Cocoa Exchange in New York City (originally established as the New York Coffee Exchange in the 1880s), which sets coffee prices according to the New York “C” contract market. The price of coffee fluctuates dramatically. Weather is often a factor, as a forecast of droughts or frosts in Brazil might also forecast a coffee shortage, thus increasing the price. Most coffee is traded by speculators in New York City, who trade up to ten times the amount of coffee that is actually produced each year.

The World Trade Organization (WTO), with its policies of free trade and trade liberalization, has also had a significant impact on coffee prices. Created in 1995, the WTO is a global organization of 134 member countries that negotiates and regulates international trade agreements.

Free trade, or trade without taxes or other restrictions, is meant to benefit both importers and exporters. However, who benefits from trade depends on the prices, and wealthier economies-countries or corporations-often impose prices at the expense of poorer ones. With no restrictions on international investments, corporations force countries to compete against one another in a “race to the bottom,” lowering wages in order to maintain business. The corporate products that have the lowest price and highest profitability on the world market win out, often devastating the economies and communities in smaller, poorer countries. Corporate ownerships and monopolies are protected over labor, the environment and sustainability.

In countries such as Ethiopia, small coffee producers have suffered as a result of the WTO. The International Monetary Fund (IMF) and the World Bank, established to facilitate global trade and regulate an international monetary system, have privatized public businesses and removed restrictions on foreign ownership in many developing countries who sign the IMF agreements in order to prevent default on international loans. Signing the IMF also includes a pledge of new loans from private international lenders. As a result, the gross national income in sub-Saharan Africa countries has been devastated, and Africa’s share of world trade has decreased-over the last 20 years, Africa’s share of world trade has fallen to one percent, and seven million people in Ethiopia are now dependent on emergency food aid every year.

Who Sets Coffee Prices

Coffee prices are based on two commodity exchanges: the LIFFE, in London, and the New York Board of Trade. Commodity futures markets are a way of managing risk by establishing a basis to determine the price of the product for producer, exporter, shipper and consumer. In the early days there were, in the main, only coffee-related companies involved. Today, with the active presence of funds playing in this field, futures markets risk adding to the volatility of prices, as demonstrated by the fact that the volume traded on coffee markets exceeds the global production by a factor of ten.

Nestle’s View on How Best to Help Farmers

Speciality Coffee

Nestlé recognises that Fair Trade is a useful way to raise consciousness about the coffee issue and for individual consumers to express their solidarity with a group of coffee farmers in the developing world.

However, if on a broad basis, coffee farmers were paid Fair Trade prices exceeding the market price the result would be to encourage those farmers to increase coffee production, further distorting the imbalance between supply and demand and, therefore,depressing prices for green coffee.

Worldwide, the Fair Trade movement accounts for less than 25 000 tonnes of green coffee. Nestlé’s direct purchasing accounts for 110 000 tonnes of green coffee per year. This system enables the farmer to retain a greater portion of the price paid by Nestlé, therefore improving his income.

One strategy to give farmers a higher income is for them to concentrate on producing speciality coffees, which are a niche market product, or to produce coffees which are labelled as organic or fair trade. These products command higher prices. Demand for speciality coffees is growing and this is reflected in the growth of the Nespresso business. Nespresso pays a premium price for this type of product.Unfortunately, this type of coffee accounts for a relatively small percentage of total sales. Speciality coffees cannot provide a solution to the broader problems facing the coffee market.

Diversification

Nestle’s CEO believes that for farmers who cannot produce speciality coffees the solution may be to diversify. Many coffee producers are over-dependent on coffee.

They need to develop new sources of income either through producing new crops or by finding alternative employment. Shift production is not straightforward. It requires additional investment and it may time for a new crop to produce a return on the investment.

Coffee growers producing new crops also face the problem of trade barriers and subsidies paid to farmers in the United States and within the European Union. Trade barriers restrict access to developed markets and subsidies make it difficult for farmers in developing countries to compete.

Nestle has argued for the trade barriers facing farmers in developing countries to be removed

Direct Selling

Farmers selling direct to the large coffee houses is one way of raising famers incomes, allowing famers to retain more of their coffee’s value. Coffee tends to be grown Due to the fact that coffee is often in remote areas. This males it hard for growers to get their product to market. As a result they tend to sell their coffee to middlemen. In some cases, coffee may be bought and resold by up to a 100 middlemen.

The creation of farmers co-operatives have benefited some groups of farmers. Co-operatives have enabled growers to avoid the need for middlemen and to export coffee on their own.

Large roasters like Nescafe have developed a direct procurement system which buys coffee direct from growers. This approach has helped the farmers supplying Nestle increase incomes.

Alternative Trading Organisations (ATOs

Recognising the important role consumers could play to improve the situation for producers, Alternative Trading Organizations (ATO) were set up. ATOs buy directly from farmers at better prices, help to strengthen their organizations and market their produce directly through their own shops and catalogues. For 40 years ATOs offered consumers the opportunity to buy products which were bought on the basis of fair trade.

This worked well, and hundreds of small, disadvantaged farmers were able to get back on their feet and trade their way out of poverty with a renewed sense of pride. But there is a limit to how many producers could benefit with fair trade sales limited to such niche outlets – not normally associated with food goods.

What Other Factors Influence the Level of World Coffee Production?

Sometimes storms, a late frost, crop disease, war, exchange rate fluctuations or other unpredictable events can force coffee farmers out of business. At other times, centralised political decisions to produce more or less will affect output levels.

Small farmers are often encouraged to grow more coffee by governments eager to boost their exports earnings. These governments are sometimes encouraged by the International Monetary Fund and the World Bank to produce more.

Can Fairtrade Offer a Better Deal?

Products such as coffee, tea and chocolate are grown in the warmer climates of the South. Prices paid for these commodities have risen little in real terms over the last forty years. During the same period the cost of fertilisers, pesticides and machinery (imported from richer countries) has increased sigificantly. Commodity prices tend to be volatile and often fall below the cost of production. Many growers are having to work harder and longer for less money.

Small farmers without direct access to the market are forced to sell to local traders who frequently exploit them. Volatile coffee prices has had a catastrophic effect on the lives of millions of small farmers, forcing many into crippling debt and countless others to lose their land.